Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance

16 Downloads

Commercial, Corporate

March 4, 2025

Sayantani Dutta

Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance

A sole shareholder resolution is a formal proposal initiated and approved by the single shareholder of a corporation to record key decisions without holding a full shareholders’ meeting. It empowers the sole shareholder to direct the board of directors on significant matters such as policy changes, governance structures, capital allocation, and long-term financial strategies.

As an integral part of corporate governance, a sole shareholder resolution template creates a structured, written record of important decisions in place of physical meetings. These written resolutions ensure that all corporate actions are properly documented, compliant with applicable laws, and aligned with the company’s long-term objectives. In many modern corporations, shareholder resolutions—especially on environmental, social, and governance (ESG) issues—have become a key mechanism for promoting accountability and transparency.

Growing concern around responsible business practices has encouraged companies to adopt governance frameworks that strengthen oversight and ensure that major decisions are transparent. Many entities have updated their articles and bylaws to enhance shareholder participation in long-term planning, risk management, and sustainability—making properly drafted resolutions even more important.

Strategic Considerations for a Sole Shareholder Resolution

Submitting a sole shareholder resolution should always align with the corporation’s legal and governance framework. The company’s articles of incorporation and bylaws typically prescribe the form, content, and process for such resolutions, including when written resolutions can be used in place of general meetings. Understanding these requirements is crucial, as procedures can vary by jurisdiction, local company law, listing rules, and internal policies.

A strategic approach begins with defining the key objective of the resolution, identifying the powers reserved to shareholders versus directors, and choosing the correct format (written resolution, special resolution, or ordinary resolution). In companies with more than one owner, shareholder proposals may also need minimum shareholding or support thresholds before they can be tabled at an annual general meeting (AGM) or extraordinary general meeting (EGM).

Even in a sole shareholder context, the directors of the corporation play an important role in implementing approved resolutions and ensuring that each decision is carried out in accordance with corporate law, fiduciary duties, and existing governance processes.

Key Aspects of Shareholder Eligibility and Rights

Shareholders intending to submit or approve resolutions must operate within the framework of securities laws, companies legislation, and the corporation’s governing documents. The articles of incorporation and bylaws typically spell out procedural requirements for filing and approving resolutions, including notice periods, thresholds, and documentation standards.

In some legal systems, even a sole shareholder resolution must follow prescribed formats to be valid—especially where the decision concerns amendments to bylaws, share capital, mergers, or other fundamental changes. Elsewhere, sole shareholder decisions may be allowed through written resolutions without any formal meeting, provided they are properly signed, dated, and recorded.

It is also important to distinguish between binding resolutions and non-binding (advisory) resolutions. A binding resolution legally requires the company to implement the proposed change, while a non-binding resolution serves as a recommendation. In a sole shareholder scenario, most resolutions are effectively binding, but companies may still maintain an internal distinction where advisory resolutions relate to policy guidance rather than specific legal actions.

These distinctions in shareholder rights, eligibility, and voting impact how strongly a resolution can shape company policy and long-term strategy.

Drafting a Strong Sole Shareholder Resolution

A well-drafted sole shareholder resolution is critical for clarity, legal compliance, and smooth implementation. The document should clearly state what is being approved, why it is being done, and under which legal authority. Where necessary, it can also reference statutory provisions, articles of association, or board recommendations to avoid ambiguity later.

Structuring the resolution with clear headings, recitals (“whereas” clauses), and numbered resolutions enhances readability and reflects governance best practices. In complex scenarios, consulting legal professionals with corporate governance expertise helps ensure that the resolution meets jurisdiction-specific requirements and accurately reflects the shareholder’s intent.

Some best practices when preparing a sole shareholder resolution include:

- Ensuring the proposal is consistent with company law, corporate governance standards, and the corporation’s long-term strategic direction.

- Supporting the proposal with relevant financial, operational, or ESG information so that the rationale is clear and defensible if reviewed by auditors, regulators, or future investors.

- Evaluating the long-term impact on shareholder value, corporate sustainability, and risk management—particularly where the resolution affects capital structure or major transactions.

- Verifying that all procedural requirements in the company’s bylaws (such as notice, form, and record-keeping) are satisfied so that the resolution is legally effective and enforceable.

Governance and Voting Considerations

In multi-shareholder companies, a shareholder proposal is typically reviewed by the board and then put to a vote at an AGM or EGM. The minutes of these meetings must record the text of the resolution, the discussion, and the voting outcome. Even for a sole shareholder resolution, maintaining similar records helps preserve a clear audit trail and demonstrates robust governance.

Where voting is required, the threshold can vary: some matters pass with a simple majority, while others (like amendments to articles, mergers, or capital reductions) may require a supermajority or special resolution. Quorum rules and any special class rights also influence how a resolution is approved.

In certain jurisdictions, shareholder names or beneficial owners must be disclosed in regulatory filings when resolutions relate to governance amendments or significant corporate actions. Proper documentation, including written resolutions, minutes, and supporting documents, is important for legal, accounting, and regulatory purposes.

Legal Implications and Compliance

Legal considerations are central to shareholder resolutions, especially where the subject matter involves mergers, changes in share capital, amendments to bylaws, or major corporate policy shifts. Companies typically seek legal review of proposed resolutions to confirm their legality, avoid conflicts with existing documents, and understand potential implications.

In many jurisdictions, private companies and closely held corporations are allowed to use a written resolution of sole shareholder in place of holding a formal meeting. In such cases, the sole shareholder signs the resolution on behalf of the company, and the document is then recorded in the company’s minute books as if passed at a general meeting. This method is efficient, flexible, and fully compliant when done correctly.

Filing and Executing a Sole Shareholder Resolution

Timely execution and filing of a shareholder resolution is crucial. Companies are generally required to issue notices for general meetings and maintain clear records, but for a sole shareholder written resolution, the focus shifts to accurate drafting, signature, and internal filing rather than formal notice to multiple shareholders.

Where resolutions are tied to AGMs or regulatory filings (for example, approving financial statements, appointing directors, or authorizing major transactions), reviewing prior proxy statements, statutory deadlines, and jurisdictional timelines ensures all procedural steps are met. Direct coordination with company officers or corporate secretaries can help clarify internal requirements and filing processes.

Challenges and Proposal Acceptance

In larger, widely held companies, shareholder proposals may be rejected for procedural defects, non-compliance with bylaws, or failure to meet regulatory standards. Some regimes provide rights of appeal or resubmission if a proposal is excluded.

In a sole shareholder environment, these challenges are less about acceptance by other shareholders and more about ensuring the resolution itself complies with company law, protects directors’ duties, and does not conflict with the articles or existing contracts. Using a reliable sole shareholder resolution template reduces these risks significantly.

Collaborative Filings and Co-Filing (for Multi-Shareholder Contexts)

Where there is more than one shareholder, co-filing allows several investors to submit a single proposal together. This can help satisfy minimum shareholding requirements, demonstrate strong investor support, and increase the perceived legitimacy of the proposal. It can also ease liquidity constraints in markets where shares must be blocked to vote.

Key considerations for co-filing include:

- Agreeing early on cost-sharing for legal, administrative, and filing expenses.

- Understanding applicable antitrust, “acting in concert,” and disclosure rules in the relevant jurisdiction.

- Exceeding minimum shareholding thresholds to allow for market fluctuations or ownership verification issues.

- Partnering with experienced co-filers who have a record of effective proposals and investor engagement.

- Aligning the text of the resolution with the group’s strategic objectives and investment thesis.

- Completing all documentation well before deadlines to avoid technical rejection.

Negotiations and Engagement After Filing

Companies may seek to negotiate with resolution proponents in exchange for withdrawing or modifying a proposal. These negotiations might result in policy commitments, new disclosures, or management-sponsored resolutions addressing the same concerns.

Whether to negotiate or maintain the resolution depends on the shareholder’s goals. If a proposal is withdrawn based on corporate commitments, it is important to set up tracking and follow-up processes to ensure those commitments are honoured. Transparent communication about such agreements also helps promote accountability.

Building Support and Participating in AGMs

In wider shareholder settings, building backing for a proposal typically involves explaining its rationale and alignment with long-term shareholder value. Strategies may include distributing supporting documents, using investor networks, engaging proxy advisors, and reaching out to key institutional investors.

AGMs provide a direct platform to present resolutions, address questions from the board and management, and highlight investor concerns. Proponents should understand the meeting’s procedural rules, speak to the company in advance to confirm logistics, and be prepared to present a concise, persuasive statement in support of the resolution.

Post-Vote Follow-Up

After the AGM or written resolution process, companies disclose voting outcomes, which provide insight into investor sentiment and the level of support for each proposal. Proponents should have a post-vote plan—monitoring how the company implements successful resolutions and evaluating the reasons behind any that did not pass.

Effective, ongoing communication helps maintain momentum, reinforces accountability, and informs decisions about whether to re-file or modify proposals in future years, subject to the applicable re-filing rules.

Why Use a Sole Shareholder Resolution Template?

A well-structured sole shareholder resolution template simplifies preparation, promotes consistency, and reduces the risk of procedural errors. By following a clear, uniform format, shareholders can ensure that each resolution is complete, legally compliant, and easy for directors, auditors, and regulators to review.

Templates encourage transparency and standardization across multiple resolutions and entities. They provide concise headings, recitals, and operative clauses that make the document easier to read and understand. This allows the shareholder to focus on the substance—objectives, legal basis, and justification—rather than worrying about layout or technical wording.

For investors submitting resolutions across several companies or jurisdictions, a robust template supports uniform drafting while still allowing local adaptation. Law firms and compliance professionals often prefer standard formats as they streamline legal review and help manage governance risk.

Ultimately, a properly crafted resolution template increases the likelihood of a successful filing, strengthens shareholder participation, and supports a more disciplined approach to corporate governance.

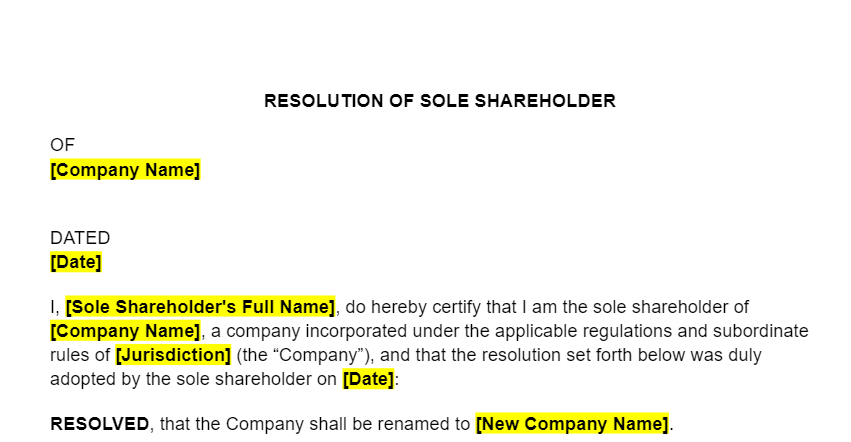

Download a Free Resolution of Sole Shareholder Template from FreshDox

Start using professionally drafted governance documents today with FreshDox. Sign up and enjoy a 7-day free trial with full access to our entire library of business and legal templates, including our Resolution of Sole Shareholder Template designed by industry professionals.

During your trial, you can explore both Basic and Premium plans, download templates, and see how FreshDox makes corporate paperwork faster, clearer, and more reliable. Whether you are a business owner, company secretary, legal professional, or advisor, our library helps you cover all your documentation needs with confidence.

Your free trial starts as soon as you sign up for a Basic or Premium account. Log in to FreshDox, download the sole shareholder resolution template, and streamline your next corporate decision with a clear, professional document that meets modern governance standards.

Popular searches:

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance pdf

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance sample

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance download

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance format

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance template

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance word

- Sole Shareholder Resolution Template: Clear, Effective Tool for Corporate Governance free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews