Bitcoin Sales Agreement Template for Confident BTC Deals

14 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

Secure, Bitcoin Sales Agreement Template for Confident BTC Deals

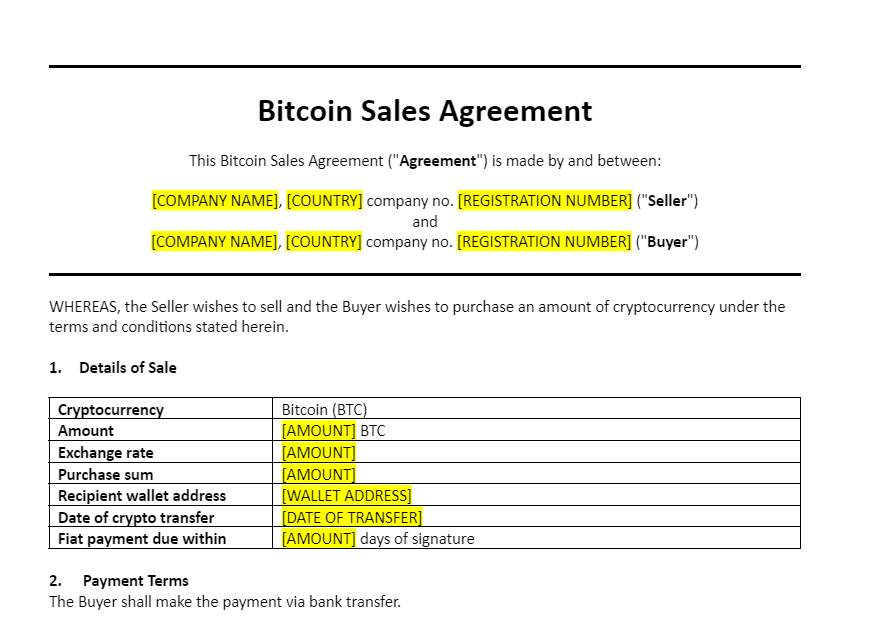

The Bitcoin Sales Agreement is a vital legal document that sets out the terms and conditions under which Bitcoin (BTC) is bought and sold. Once upon a time, selling Bitcoin felt as simple as sending coins from one wallet to another. Today, with organizations, funds, and high-net-worth individuals entering the market—and regulators watching closely—that is no longer enough. Taxation, reporting, and regulation now differ widely between jurisdictions, and you need stronger legal and technical protections to ensure every BTC sale is executed securely and transparently.

A well-crafted Bitcoin Sales Agreement (or Bitcoin sale contract) clearly sets out the commercial and legal framework for the transaction. It covers important variables such as market price considerations, liquidation control, the payment method and schedule, warranties and waivers, dispute resolution, governing law, and compliance obligations. In short, it connects the technical side of a BTC transfer with the legal realities of modern crypto regulation.

This agreement is designed to protect both the buyer and the seller by clearly defining their rights, obligations, and interests. It typically specifies the exact quantity of BTC to be sold, the price or pricing mechanism, how and when payment will be made, when the coins will transfer on-chain, and what happens if something goes wrong. With a strong Bitcoin purchase agreement, the entire flow—from wallet to bank account—is supported by a structured legal shield.

A Bitcoin Sales Agreement template can be used in a variety of contexts—an organization converting part of its BTC treasury into USD for liquidity, an investor rebalancing a personal portfolio, or a business integrating digital assets into its long-term financial strategy. In all such cases, this agreement holds the covenants, disclaimers, and rules under which the sale will happen, reducing avoidable risk for both parties.

In this article, we will break down what makes a good Bitcoin Sales Agreement, why generic or free templates can be dangerous, and which key clauses you should never ignore. To close, we will introduce FreshDox.com’s Bitcoin Sales Agreement Template—a professional, customizable starting point whether you are running a business in New York, investing from Delaware, or selling BTC across borders. Best of all, the same structure can easily be adapted to other major cryptocurrencies like Ethereum.

Cryptocurrency Purchase Agreement: Importance & Benefits

The crypto market is volatile, global, and constantly changing. New tokens launch every day, and regulations are evolving just as quickly. In this environment, relying on informal chats, DMs, or screenshots is no longer enough—especially for business-oriented or sensitive transactions. You need a Bitcoin Sales Agreement firmly underpinning any meaningful BTC sale.

A robust Bitcoin sale contract makes sure that transactions are conducted securely, transparently, and enforceably. It acts as a legal safeguard, giving both parties clarity and confidence. By documenting key terms such as price, timing, payment method, and transfer conditions, the agreement dramatically reduces the risk of misunderstandings, missed expectations, or disputes.

A comprehensive Bitcoin Sales Agreement template also mitigates disputes by setting out a clear framework for legal recourse if terms are breached. Instead of arguing about “what was agreed,” both sides can refer back to a signed, structured document with detailed clauses on remedies, default, and dispute resolution.

However, the agreement does more than just define commercial terms and risk-mitigation language. In today’s environment, it also plays a critical regulatory role. Around the world, legislatures and regulators are introducing rules on digital assets, reporting, and taxation. Your Bitcoin purchase agreement can help you align your transaction with these legal requirements.

Because a Bitcoin Sales Agreement is drafted under specific governing law, it can offer protections around anti–money laundering (AML), know-your-customer (KYC) obligations, cross-border transfers, and tax reporting. For example, if a limited liability company in the United States sells BTC to a buyer in Hong Kong, the agreement can include explicit clauses and representations to reduce the risk that this transaction is flagged as suspicious or non-compliant.

This is the real strength of a good Bitcoin Sales Agreement: it helps you convert held BTC into USD or another fiat currency while protecting both the technical execution and the legal, regulatory, and tax implications across multiple jurisdictions.

For individuals, corporates, funds, or global traders participating in the BTC market, this type of agreement is an essential tool to ensure compliance, maintain transparency, and safeguard every high-value transaction.

What Happens If You Don’t Have a Good Bitcoin Sales Agreement?

A strong Bitcoin Sales Agreement does a lot of heavy lifting: it clarifies transaction details, frames dispute resolution, and helps ensure regulatory compliance. Operating without such a contract—especially for large or cross-border BTC sales—is a serious risk and can easily become an expensive mistake.

Without a formal agreement, there is a high probability of misunderstandings around core transaction details such as price, exact BTC quantity, timing, payment methods, fees, and even which network or wallet address is to be used. These problems do not only arise in institutional deals; even smaller, peer-to-peer transactions can go wrong when expectations are not written down clearly.

Those misunderstandings can quickly escalate into disputes and financial loss. For example, the seller might believe the price was fixed at signing, while the buyer believes it is based on the spot rate at the moment of transfer. Without a documented rule, both parties may feel justified in their interpretation—and the transaction can collapse.

In addition, failing to use a legally binding Bitcoin sale contract leaves you exposed from a compliance perspective. With regulators scrutinizing digital asset flows more closely, the absence of a clear, written agreement can result in non-compliance with AML/KYC standards, sanctions rules, or tax reporting obligations, leading to penalties or unwanted regulatory attention.

Another common risk arises when people rely on free, generic BTC contract templates downloaded from random websites. These documents may be outdated, incomplete, or not tailored to the realities of your jurisdiction or your specific transaction. They often fail to address cross-border issues, modern regulatory requirements, or the operational details of how Bitcoin actually moves on-chain.

In the worst case, a badly designed template can provide a false sense of security while still leaving both buyer and seller exposed. In practical terms, this is almost as risky as having no Bitcoin Sales Agreement at all.

The Key Elements of a Bitcoin Sales Agreement

A strong, professional Bitcoin Sales Agreement template is built around a few core sections. You may add or remove clauses depending on the specific deal, but these eight elements are especially important when drafting a solid, legally sound agreement for BTC sales. If you review well-crafted BTC contracts, you will see these themes repeating again and again.

These key sections usually include:

-

Identification of Parties

: The agreement must clearly identify the parties involved—both the BTC seller and the buyer. This includes full legal names, addresses, and contact details. For entities, it may also include company registration numbers and authorized signatories. This foundational step ensures there is no confusion about who is responsible for what under the Bitcoin Sales Agreement. -

Description of the Asset

: The contract should provide a detailed description of the digital asset. For Bitcoin, this means specifying that BTC is the asset being sold and stating the precise quantity to be transferred. It is good practice to include the BTC amount and the reference market value at the time of signing, along with a timestamp or price index. In a volatile market, these details are crucial to avoid confusion later. -

Transaction Terms

: Here, you outline the commercial heart of the deal. This includes the agreed price or pricing formula, the settlement currency (e.g., USD, EUR), any price adjustment mechanisms, and critical dates or deadlines. You may also include contingencies or specific execution instructions—for example, whether an escrow service will be used, or what conditions must be satisfied before funds or BTC move. -

Payment Method

: This section details how the buyer will pay for the BTC—via bank transfer, stablecoin, another cryptocurrency, or a regulated escrow. It should outline payment routes, bank details or wallet addresses, and any security steps (such as using multi-signature wallets or custodians). Clear payment terms greatly reduce the risk of misdirected funds or delayed settlement. -

Transfer of Ownership

: A key clause in any Bitcoin sale contract is the transfer-of-ownership provision. Unlike traditional assets, BTC ownership is recorded on the blockchain. The agreement should specify exactly when ownership passes—for instance, upon receipt of cleared fiat funds, or after a defined number of blockchain confirmations to the buyer’s wallet. It should also outline what each side must do (e.g., providing the correct wallet address, verifying transactions) to complete this transfer. -

Representations and Warranties

: Both parties should make certain assurances. The seller typically confirms that they own the BTC free of liens, are not using stolen or restricted funds, and have the legal authority to sell. The buyer confirms that they are authorized to purchase Bitcoin, that their funds are legitimate, and that they understand the risks of crypto assets. These representations and warranties help prevent legal challenges and fraud-related issues later. -

Compliance and Regulatory Considerations

: A modern Bitcoin purchase agreement must address compliance. This section usually confirms that both parties will adhere to applicable AML, KYC, sanctions, and tax laws. Depending on the jurisdictions involved, it may require the exchange of identity documents, source-of-funds information, or specific declarations. This is especially critical when the deal involves cross-border transfers or corporate entities. -

Dispute Resolution

: Finally, the agreement must explain how disputes will be resolved. Options may include negotiation, mediation, arbitration, or court proceedings. This section often specifies the seat of arbitration or the courts that will have jurisdiction, and it clarifies that the agreement is governed by the law of a particular state or country. A clear dispute resolution clause makes conflict management faster, cheaper, and more predictable.

Together, these elements form the backbone of a strong Bitcoin Sales Agreement template. You can always expand or adapt them for your own use case, but leaving them out entirely is rarely a good idea.

Sell Bitcoin Safely with FreshDox.com’s Bitcoin Sales Agreement Template

When it comes to selling Bitcoin, ensuring your transaction is secure, transparent, and legally enforceable is non-negotiable. Without a comprehensive BTC contract in place, you risk misunderstandings, delayed payments, unrecoverable losses, and even regulatory trouble.

That is exactly where FreshDox.com’s Bitcoin Sales Agreement Template comes in. Our expertly drafted template is designed to help you handle the complexities of Bitcoin transactions—especially larger or cross-border sales—with confidence and clarity.

The FreshDox Bitcoin Sales Agreement template includes all the essential clauses you need: identification of parties, asset description, transaction terms, payment method, transfer of ownership, representations and warranties, compliance obligations, and dispute resolution. Each section is written in professional, contract-ready language you can adapt to your specific deal.

Whether you are executing a one-off Bitcoin sale or managing BTC as part of a broader digital asset strategy, our template offers a clear, legally binding framework that eliminates ambiguity and safeguards your interests. You avoid the pitfalls of outdated, incomplete, or generic templates, and you gain a structure built with today’s regulatory environment in mind.

FreshDox.com keeps its templates up to date with the latest best practices, and each document is fully customizable. Download the Bitcoin Sales Agreement in Word or PDF, add your transaction details, and easily tailor clauses to reflect your jurisdiction, transaction size, or internal policies.

When you sign up, you also unlock access to a wider library of legal, business, and crypto-related agreement templates. With a 14-day trial and flexible Basic (limited downloads) and Premium (unlimited downloads) plans, you can explore what works best for your workflow.

Take the first step towards safer, smarter BTC deals today. Sign up for FreshDox.com, access our Bitcoin Sales Agreement Template, and protect your digital assets with a robust, legally sound document designed to keep your Bitcoin transactions smooth, compliant, and dispute-free.

Popular searches:

- Bitcoin Sales Agreement Template for Confident BTC Deals pdf

- Bitcoin Sales Agreement Template for Confident BTC Deals sample

- Bitcoin Sales Agreement Template for Confident BTC Deals download

- Bitcoin Sales Agreement Template for Confident BTC Deals format

- Bitcoin Sales Agreement Template for Confident BTC Deals template

- Bitcoin Sales Agreement Template for Confident BTC Deals word

- Bitcoin Sales Agreement Template for Confident BTC Deals free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews