Convertible Note Term Sheet Template: Essential Guide for Startup Funding

10 Downloads

Money and Finances

March 4, 2025

Sayantani Dutta

Convertible Note Term Sheet Template: Essential Guide for Startup Funding

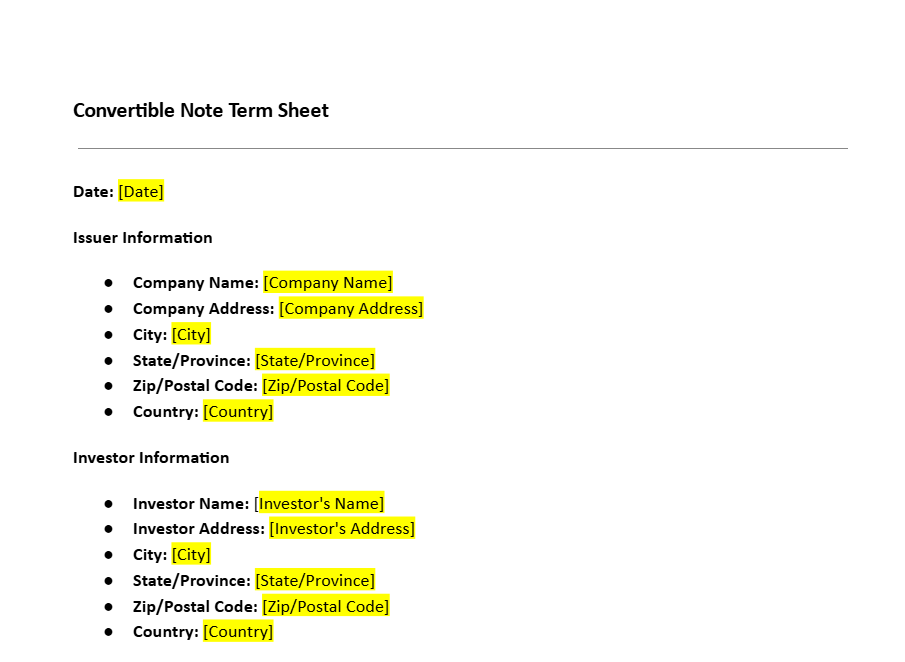

A convertible note term sheet is a non-legally binding (but morally and commercially important) document that records the key terms agreed between a startup and its investors before issuing a convertible note. It acts as the roadmap for the final, legally binding convertible note instrument, ensuring that the rights, obligations, and economics of the deal are fully understood before detailed drafting and due diligence begin.

A convertible note is one of the most widely used ways for early-stage companies to raise capital. In simple terms, it is a loan that converts into equity at a later date under predefined conditions, instead of being repaid in cash. When the note converts, the investor receives preferred shares or common stock, usually at a discount and/or subject to a valuation cap, rather than the principal and accrued interest being repaid in cash.

A convertible note term sheet is therefore a concise but powerful summary of this convertible security and is typically used in situations such as:

- Preparing for a seed or pre-seed investment round, where founders and investors need a clear, investor-friendly summary of all negotiated terms to move quickly to funding.

- Documenting a convertible loan arrangement with relatively standardized terms, including the discount rate and/or valuation cap that will apply when the note converts into equity at a future qualified financing.

Convertible notes are often seen as investor-friendly alternatives to SAFEs (Simple Agreements for Future Equity). A convertible note term sheet is usually signed early in the process, once the preliminary financing terms have been agreed, but before extensive due diligence and definitive documentation. Well-drafted term sheets can include practical guidance, drafting notes, alternate clauses, optional protections, and clear commercial economics.

Two of the most important investor-focused features reflected in a convertible note term sheet are the maturity date and the interest rate. The maturity date provides a backstop: if no equity financing occurs by that date, the noteholder can demand repayment or re-negotiate terms. The interest rate compensates investors for taking early-stage risk and allows the principal to grow over time, increasing the equity received on conversion.

Importance of a Convertible Note Term Sheet

Many startups are not yet ready to agree a formal valuation when they first raise capital. Convertible note financing allows them to raise funds quickly while postponing the valuation discussion until a later, priced round. A well-structured convertible note term sheet template helps founders and investors move fast, stay aligned, and avoid unnecessary friction.

Some of the important benefits of using a convertible note (and documenting it via a clear term sheet) include:

-

Quick and Simple to Create:

A convertible promissory note can generally be structured more quickly than a full equity round. With a clear convertible note term sheet, startups can lock terms with investors within a day or two, without incurring the cost and time of immediate share issuance or complex cap table changes. -

Limited Immediate Dilution:

Because shares are not issued upfront, existing founders and shareholders are not immediately diluted. Conversion happens later—typically following a qualified equity financing round—once there is more data and a clearer sense of valuation. This reduces the risk of losing control too early and can also have tax advantages in some jurisdictions. -

Valuation Flexibility:

Early-stage valuation is notoriously difficult. A convertible note allows the parties to delay setting a formal share price. Instead, investors are rewarded for early risk with a discount rate (percentage discount to the future round price) and/or a valuation cap (a maximum company valuation at which the note converts). Over time, the number of shares issued to the investor is driven by the financing amount plus accrued interest, providing meaningful upside if the company performs well.

In short, a clear, well-structured convertible note term sheet lets founders focus on product and market, while still giving investors commercial protections and upside for their early commitment.

Risks of Convertible Notes (and Why a Good Template Matters)

Despite their advantages, convertible notes carry real risks for both startups and investors if they are not properly documented. To protect capital on both sides, you should use an accessible, professional convertible note term sheet template that clearly outlines all key financing terms. This significantly reduces the chance of expensive, time-consuming legal disputes later.

Investors take substantial risk by providing capital at an early stage, often before product–market fit or significant revenue is achieved. Convertible Note templates by FreshDox.com help minimize that risk by clearly stating the principal terms of this short-

Popular searches:

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding pdf

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding sample

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding download

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding format

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding template

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding word

- Convertible Note Term Sheet Template: Essential Guide for Startup Funding free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews