Credit Card Authorization Form Template

10 Downloads

Commercial, Money and Finances

March 4, 2025

Sayantani Dutta

Credit Card Authorization Form Template for Secure Payments

Processing credit card payments safely is not just a convenience—it is a compliance and risk-management necessity. A structured credit card authorization form template gives your business a standardized way to capture cardholder information, record consent, and process transactions in line with security standards.

Instead of collecting sensitive details in emails, on loose paper slips, or through informal messages, a credit card payment form centralizes all the information needed to authorize a charge. This supports secure payment handling, reduces clerical errors, and gives you a clear record to rely on if a customer later questions a transaction or files a chargeback.

A well-designed credit card authorization form also strengthens customer confidence. When clients see that you use a professional, structured payment form with clear terms, they are more comfortable sharing their card details, knowing that your processes prioritize security and transparency.

Without a clear framework for collecting and storing card data, businesses risk processing delays, security breaches, and compliance violations that can seriously damage reputation and customer relationships. A standardized credit card payment authorization form helps you avoid these pitfalls and run payments smoothly.

Why Do You Need a Credit Card Payment Form?

Any business handling cardholder data must treat accuracy and security as top priorities. A credit card authorization form standardizes how transactions are approved and processed, minimizing technical errors, human mistakes, and disputes.

In retail, hospitality, professional services, healthcare, and online businesses, a signed credit card authorization form is one of the best tools to prevent fraud and reduce chargebacks. Written or digitally captured authorization gives merchants clear permission to charge the customer’s credit card, and the completed form becomes key evidence if a bank or payment processor later questions the charge.

These payment forms also simplify record-keeping. Instead of relying on handwritten notes or informal agreements, businesses maintain organized payment histories with dates, amounts, and authorization details in one place. This structure makes reconciliation, accounting, and audit preparation significantly easier.

For businesses offering one-time payments, subscription plans, or installment billing, a credit card payment form also clearly sets out the terms and conditions of payment. Customers acknowledge the amount, billing frequency, and total to be charged, which reduces confusion and disputes over future transactions.

Legal protection is another major benefit. A clearly worded credit card authorization form template can define refund policies, cancellation rules, and dispute procedures. When a disagreement arises, your business has a documented record of the customer’s authorization and acceptance of these terms, lowering liability and speeding up resolution.

Certain industries such as law, healthcare, consulting, and professional services may require signed authorization before billing clients, particularly for high-value or recurring transactions. A compliant, standardized credit card authorization template helps these businesses align with industry regulations and client expectations.

E-commerce stores and subscription platforms also depend on digital payment forms integrated into secure gateways. A credit card payment form embedded in a PCI-compliant system or ACH gateway supports smooth online transactions, reduces friction at checkout, and protects sensitive card data.

For companies handling international customers, a well-structured credit card authorization form makes it easier to explain currency conversion, exchange rates, and any additional fees tied to cross-border payments. Documenting these details upfront prevents confusion and keeps cross-border transactions transparent.

Without a standardized credit card authorization form, businesses expose themselves to avoidable risks—chargebacks, data entry errors, weak documentation, and non-compliance with card network rules and data protection standards.

What Does a Credit Card Payment Form Include?

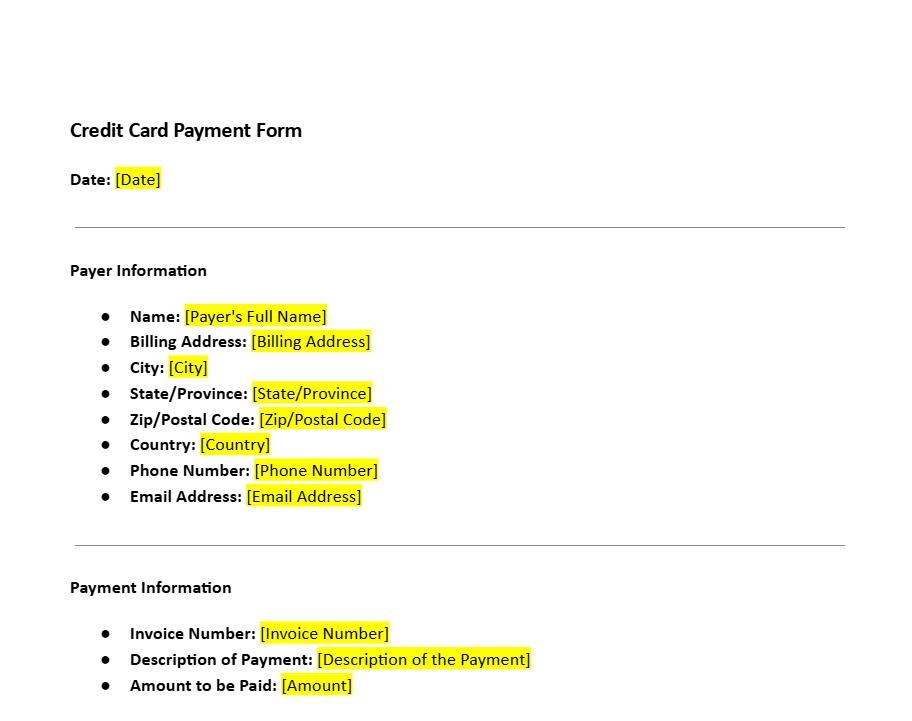

Essential Payment and Cardholder Information

A professional credit card payment form template gathers all the key details required to process a transaction securely and accurately. Common fields include:

- Cardholder’s full name

- Billing address and contact information

- Credit card number (or masked entry in a secure system)

- Expiration date

- Security code (CVV/CVC)

- Transaction amount or authorized charge range

Some businesses also include internal references—such as account numbers, invoice numbers, customer IDs, or order numbers—to simplify reconciliation and reporting. The form can also specify card type (e.g., Visa, Mastercard, American Express, Discover) to route transactions correctly through payment processors.

Recurring Billing and Subscription Authorization

Beyond one-time purchases, many companies use a recurring credit card authorization form to support subscriptions, memberships, retainers, and installment plans. In such cases, the payment form clearly indicates:

- Billing frequency (weekly, monthly, quarterly, annually)

- Amount per billing cycle or price tiers

- Start date and, where applicable, end date

- Conditions for pausing, changing, or canceling the subscription

Recurring payment authorization reduces administrative workload, keeps cash flow predictable, and saves time for both the customer and the business. For organizations using ACH processors, the form may also capture bank account details and routing numbers to authorize direct debits instead of card charges.

Security Features and Compliance Details

Security and compliance are central to any credit card authorization form template. Payment forms typically include statements explaining how the business stores, handles, and protects cardholder data, referencing PCI DSS (Payment Card Industry Data Security Standard) and other applicable regulations.

In a digital environment, sensitive card data may be encrypted or tokenized. The form can indicate that the business will not store full card numbers on local systems and that only authorized personnel or systems may access limited, masked information for processing and refunds.

Legal Disclaimers and Terms of Use

A well-drafted credit card authorization form also functions as a mini-contract. It often contains clauses that clarify:

- Refund and cancellation policies

- How disputes and chargebacks will be handled

- Customer responsibilities for safekeeping their card and notifying of fraud

- Consent to recurring billing, if applicable

The form will usually contain a statement where the customer confirms they are the authorized cardholder and that they voluntarily approve the transaction according to the stated terms. This signed acknowledgment becomes vital evidence in chargeback investigations.

Electronic Signatures and Digital Payment Processing

Modern credit card payment authorization forms are increasingly built with electronic signatures in mind. Customers can sign on-screen via desktop or mobile, eliminating paper while creating a legally valid record of consent.

For e-commerce businesses, payment forms are often integrated directly into secure payment gateways. This avoids offline handling of card data and keeps the entire process inside a PCI-compliant environment. The result is faster processing, fewer errors, and a more convenient experience for both customers and business owners.

What Value Does a Credit Card Payment Form Provide?

The real value of a credit card payment form lies in its ability to combine security, clarity, and operational efficiency. It protects the business against unnecessary risk while making it easier for customers to pay.

For organizations processing high volumes of transactions, a consistent, well-structured payment mechanism reduces administrative workload. Instead of manually verifying each transaction, staff can rely on standardized forms and automated workflows to authorize, store, and reconcile payment information.

Security is always a major concern when handling card details. Encryption, tokenization, and disciplined handling practices protect customer information from theft and misuse. Businesses that align with PCI DSS and other data protection regulations significantly lower their exposure to penalties, data-breach costs, and reputational harm.

A polished, clearly worded payment form also builds trust. When customers see a professional credit card authorization form with transparent policies on refunds, billing schedules, and data usage, they are more likely to complete their purchase and return in the future.

Companies offering subscriptions, memberships, or installment plans benefit from a precise billing framework. Clear authorization and published terms reduce disputes over “unexpected” charges and support higher customer retention, because clients know exactly how and when they will be billed.

When chargebacks or disputes do occur, a thoroughly documented credit card payment authorization form can be the difference between keeping or losing revenue. Processors and banks frequently request proof that the cardholder authorized the transaction; a signed form gives you strong, traceable evidence to support your case.

In many industries, legal protection is non-negotiable. Including clear terms and conditions within the payment form helps protect the business if a customer claims a transaction was unauthorized or misunderstood. Strong documentation, combined with consistent record-keeping, makes reconciliation and compliance audits much more straightforward.

As your business scales across channels—online, in-person, and over the phone—standardized credit card authorization forms ensure consistency. Every transaction follows the same protocol, which supports efficient training, process control, and multi-location operations.

How Templates Simplify Drafting a Credit Card Payment Form

Designing a compliant, customer-friendly credit card authorization form from scratch can be time-consuming and complex. You need to balance legal language, security disclosures, card network requirements, and customer clarity—all in a single document.

A ready-made credit card authorization form template makes this process easier. Instead of starting with a blank page, you begin with a structure that already includes:

- Cardholder details and billing information fields

- Transaction amount and recurring billing options

- Security and data-handling clauses

- Refund and cancellation terms

- Signature blocks for physical or electronic signatures

You can then customize labels, add your logo, adjust legal wording in consultation with your advisor, and adapt the form to your workflows—whether in Word, PDF, or a digital form builder. This approach saves time, lowers drafting errors, and keeps your payment process aligned with best practices.

Download a Credit Card Authorization Form Template with a Free Trial of FreshDox

If you want to make payment collection safer, smoother, and more professional, start with a high-quality credit card authorization form template. With FreshDox, you get instant access to a professionally drafted credit card payment form that you can download, edit, and deploy in your business within minutes.

Begin a free 7-day trial of FreshDox on a Basic or Premium account to unlock this template plus hundreds of other business, finance, HR, and legal forms. Our templates are easy to customize, available in Word and PDF formats, and designed to support real-world workflows for small businesses, agencies, professionals, and growing companies.

Use FreshDox as your trusted partner for contracts, forms, and business documents, and ensure every transaction is backed by a secure, compliant, and clearly worded credit card authorization form template that protects both your customers and your business.

Popular searches:

- Credit Card Authorization Form Template pdf

- Credit Card Authorization Form Template sample

- Credit Card Authorization Form Template download

- Credit Card Authorization Form Template format

- Credit Card Authorization Form Template template

- Credit Card Authorization Form Template word

- Credit Card Authorization Form Template free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews