Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals

18 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals

Cryptocurrency trading has moved from niche forums to mainstream finance. As volumes grow and digital assets like Bitcoin, Ethereum, and stablecoins become part of serious portfolios, the need for a secure, clearly drafted Cryptocurrency Sales Agreement has never been greater. Whether you are selling BTC for USD, swapping tokens, or closing a private OTC deal, a written crypto sale agreement is your primary shield against disputes, fraud, and regulatory trouble.

A well-drafted cryptocurrency sales agreement template sets out exactly how the sale will happen—price, quantity, timing, wallets, banking steps, and what happens if the market suddenly moves. It also adds crucial layers of protection with warranties, waivers, disclaimers, and clauses covering issues such as fiat price fluctuations, exchange-rate risk, chargebacks, dispute resolution, arbitration, and applicable law. In short, it protects the whole transaction—from the BTC in your wallet to the fiat in your bank account.

As regulators around the world tighten rules on digital assets, a legally binding crypto purchase agreement is no longer optional. It not only captures the business terms; it also hardwires compliance with AML, KYC, and other regulatory expectations into your transaction. Done right, the agreement brings together the technical, financial, and legal aspects of a crypto sale in one powerful, enforceable document.

In this guide, we explain what a Cryptocurrency Sales Agreement is, why it matters, what clauses it should contain, and the risks of relying on generic or free templates for high-value crypto deals. Finally, we introduce the professionally drafted Cryptocurrency Sales Agreement Template by FreshDox.com—a customizable, legally sound solution built to simplify your transactions while helping you stay aligned with evolving regulations.

Whether you are an individual investor, an NGO diversifying into digital assets, or a limited liability company building a crypto treasury, the right agreement—drafted under the correct governing law—can save you from expensive legal fees and painful mistakes when you need liquidity for your digital assets.

If you are involved in cryptocurrency sales in any capacity—personal trades, OTC deals, corporate treasury management, or institutional allocations—this article will show you why a robust crypto sale agreement template is essential, what it must include, and how FreshDox.com can help you execute safer, more transparent transactions every time.

Crypto Sale Agreement: Why It Truly Matters

Crypto transactions are often conducted across borders, between parties who may never meet in person and sometimes operate in different time zones and legal systems. That is the reality of the blockchain economy—but it also increases the scope for confusion, misunderstanding, and conflict if there is no cryptocurrency sale contract to anchor the deal.

Regulation of blockchain and digital assets is still uneven and evolving. Some jurisdictions treat crypto as property, others as a financial instrument, and many have live or upcoming AML/KYC obligations. If you are not protecting your transactions with a structured Crypto Sale Agreement, you are effectively waiving your right to many of the protections that governing law could offer you.

A Crypto Sale Agreement acts as the legal foundation of the transaction. It aligns buyer and seller on the exact terms of the sale and ensures that those terms are enforceable. Without it, you face heightened risk of financial loss, miscommunication, and legal complications.

First, the agreement defines the core economics of the deal: which cryptocurrency is being sold (e.g., BTC, ETH, an altcoin, or a stablecoin), the agreed price or pricing mechanism, payment method, transfer process, and the timeline for both fiat and on-chain legs of the transaction. In a market where prices can swing dramatically within minutes, this clarity is essential to avoid conflict.

Second, it provides legal protection. As crypto attracts more regulatory scrutiny, a comprehensive agreement helps ensure that the transaction respects AML, KYC, sanctions, and other compliance requirements. Whether you are buying or selling, you do not want your transaction to be frozen or questioned because it was poorly documented or non-compliant.

Third, the cryptocurrency purchase agreement acts as mutual protection. For the seller, it helps secure timely and complete payment. For the buyer, it creates a clear obligation for timely token transfer. If either side defaults, the agreement provides a legal route to enforce performance or claim remedies—something you simply do not have with an informal chat or a generic, vague template.

Finally, a well-crafted crypto sale contract sets out how disputes will be resolved. Whether disagreements arise around timing, completed transfers, wallet addresses, or price calculations, having a dispute resolution mechanism—from negotiation and mediation to arbitration—prevents minor issues from escalating into destructive legal battles.

In simple terms, a Crypto Sale Agreement is not a bureaucratic formality; it is a practical, essential risk-management tool that protects your rights, supports regulation-ready transactions, and preserves trust between buyer and seller.

The Hidden Risks of Not Using a Proper Crypto Sale/Purchase Agreement

Just as you trust the blockchain to validate transfers, you need a legal framework you can trust to validate the transaction itself. The safest way to build that trust is with a clearly drafted cryptocurrency sales agreement tailored to your transaction—not a random PDF you find online.

The crypto market is fast, volatile, and unforgiving. Skipping a proper agreement or using a generic, free template might save you a few minutes today, but it can cost you dramatically more later. Without a robust crypto sale agreement template, you are exposed to risks that affect your money, your reputation, and even your legal standing.

1. Misunderstandings and Ambiguity

Remote transactions across jurisdictions increase the chances of ambiguity—over price, token type, quantity, fees, on-chain network, confirmation counts, or even which stablecoin is being used. Vague or incomplete terms can quickly turn into disputes, delayed transfers, and broken deals. A clear crypto purchase agreement eliminates this uncertainty with precise, written terms.

2. Regulatory and Compliance Exposure

Crypto laws and tax rules vary widely between countries and are constantly changing. Many deals require specific AML, KYC, and reporting steps to avoid getting flagged by exchanges, banks, or regulators. A weak or generic template might ignore these obligations entirely. A missing clause or compliance step can lead to frozen funds, penalties, or a deal that becomes unenforceable in court.

3. No Clear Dispute Resolution Path

If something goes wrong—no payment, no token transfer, technical error, or a disagreement over timing—what happens next? Without a formal bitcoin sale contract or broader cryptocurrency sale agreement, you may have no defined route for resolving the issue. A properly drafted agreement specifies how disputes will be handled, where, and under which rules, giving both sides a clear and efficient path to resolution.

4. Financial Loss and No Enforceability

Without a signed, structured agreement, you may find it difficult—or impossible—to enforce your rights if the other party walks away, delays payment, or refuses to transfer tokens. Recovering losses can become a long, expensive exercise with no guarantee of success. A properly drafted cryptocurrency sales agreement template significantly improves your ability to enforce obligations and recover losses.

5. Damage to Reputation and Future Deals

In a community-driven industry like crypto, reputation is capital. Deals that end badly because there was no proper agreement—or because the terms were unclear—can quickly harm your standing in the market. Conducting business with professional, clearly documented agreements signals that you take counterparties, law, and risk seriously.

In short, not using a proper cryptocurrency sales agreement template means gambling with your assets, relationships, and long-term credibility. The time you invest in using a well-structured, legally sound agreement is a small price to pay for the protection and clarity it offers.

What Makes an Ideal Bitcoin or Crypto Sales Agreement? Key Components

Whether you are a New York institutional desk or an individual seller in Delaware, the anatomy of a strong Crypto Sales Agreement is broadly similar. It combines clear commercial terms with compliance, risk-management, and enforceability. Liquidating BTC for U.S. Dollars—or any other crypto-fiat pairing—is not a casual transfer; done incorrectly, it can trigger banking flags, tax queries, or enforcement questions that may require expensive legal support.

Here are the key components that an effective Cryptocurrency Sales Agreement should contain:

-

Identification of the Parties

: Clearly identify the buyer and seller with full legal names, addresses, and contact details. For entities, include registered names, registration numbers, and, where relevant, authorized signatories. This removes any ambiguity about who is bound by the crypto sale contract and who is responsible for performance. -

Description of the Asset

: Specify exactly what is being sold—Bitcoin (BTC), Ethereum (ETH), another token, or a basket of crypto assets. Include the quantity, the network (e.g., BTC mainnet, ERC-20, BEP-20), and the reference fiat value (USD, EUR, etc.) if relevant. Clarify whether partial units (e.g., satoshis) are involved. This avoids disputes about what the buyer is actually receiving. -

Transaction Terms

: Lay out the agreed price, pricing formula (spot rate, VWAP, or an oracle feed), timing, and any conditions tied to the sale. Explain whether payment is upfront, via escrow, or staged. If the transaction unfolds over more than one day, include how price volatility will be handled. This is one of the most important parts of any crypto purchase agreement. -

Payment Method

: Describe how payment will be made—fiat wire transfer, on-chain stablecoins, another cryptocurrency, or a mix. For fiat, include details like bank account, SWIFT/IBAN, and cut-off times. For crypto, include exact wallet addresses and networks, along with any confirmation requirements before the sale is deemed final. -

Transfer of Ownership

: Define when legal and beneficial ownership of the cryptocurrency passes from seller to buyer. Is it upon receipt of cleared funds, upon a certain number of on-chain confirmations, or on another trigger? This section ensures there is no doubt about when the risk and reward of the asset transfer. -

Representations and Warranties

: Both parties should confirm that they are legally capable of entering into the cryptocurrency sale agreement. The seller typically warrants that they own the assets free of liens and have the right to sell them; the buyer warrants that the funds are lawfully obtained and that they are not subject to sanctions or restrictions that would make the transaction illegal. -

Compliance and Regulatory Considerations

: This section sets out AML, KYC, sanctions, and tax-related obligations. It may require both parties to provide identification, source-of-funds information, and to comply with all relevant laws in their jurisdiction. For larger or cross-border deals, this part of the crypto sale agreement template is especially important. -

Dispute Resolution

: Even in good-faith transactions, disagreements can arise. A dispute resolution clause sets out whether issues will be handled through negotiation, mediation, arbitration, or litigation, and in which forum. Having this pathway pre-agreed in the Cryptocurrency Sales Agreement can save time, money, and stress later. -

Governing Law

: This clause identifies which jurisdiction’s laws govern the agreement. Given that cryptocurrency laws differ significantly worldwide, clarity on governing law is essential for enforceability and for assessing legal risk. Whether you opt for New York law, English law, or another jurisdiction, both parties must know the legal environment that applies.

Together, these components form the backbone of an effective Cryptocurrency Sales Agreement. Addressing each point clearly helps protect both parties, minimize risk, and support smooth, compliant execution of every crypto deal.

Secure & Transparent Cryptocurrency Sales with FreshDox.com

In crypto, security and transparency are not luxuries—they are survival requirements. Whether you are a buyer, seller, broker, or business, having a professionally drafted, legally robust cryptocurrency sales agreement template is the safest way to protect your capital and your counterparties in every transaction.

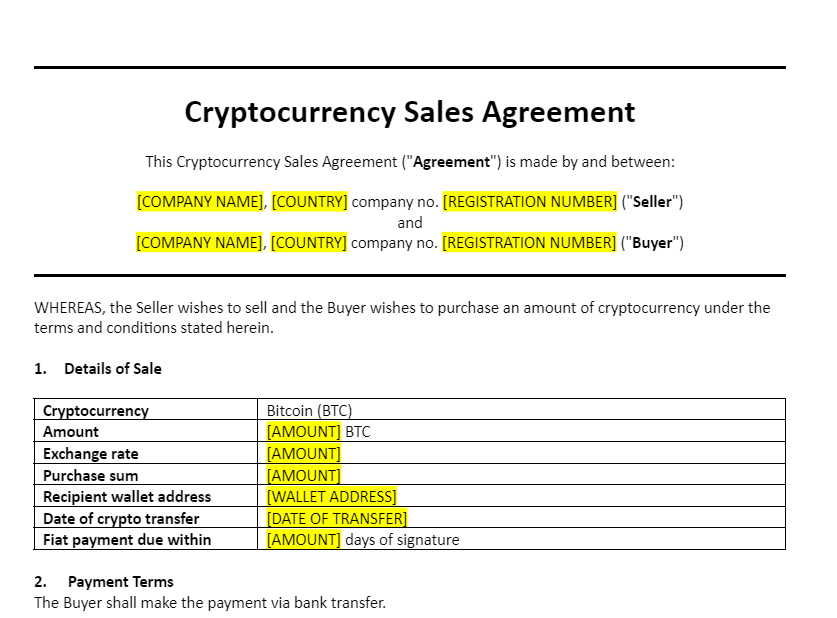

FreshDox.com’s Cryptocurrency Sales Agreement Template takes the complexity out of drafting from scratch. Our expert-built template gives you a clear, structured, and customizable crypto sale agreement that covers all key aspects of the transaction—from identification of parties and asset description to pricing, payment, transfer mechanics, compliance, and dispute resolution.

Whether the deal involves Bitcoin, Ethereum, or any other digital asset, you can adapt the FreshDox.com template to your specific transaction, add your own commercial terms, and have confidence that the document reflects current regulatory thinking around KYC, AML, and cross-border digital asset activity.

Beyond pure protection, our template also adds efficiency. With a ready-to-use, legally structured cryptocurrency sales agreement in place, you spend less time reinventing documents and more time closing deals. Built-in dispute resolution clauses and clear governing law provisions further reduce the risk of drawn-out conflicts, helping you resolve issues quickly and professionally if they arise.

In short, FreshDox.com helps you move from risky, informal transactions to secure, transparent, and legally sound cryptocurrency sales. Whether you handle occasional personal trades or manage crypto as part of a larger business strategy, our Crypto Sales Agreement Template gives you the clarity, protection, and confidence you need.

Do not leave your digital asset transactions to chance. Sign up with FreshDox.com today, access our comprehensive Cryptocurrency Sales Agreement Template, and take control of your crypto deals with a powerful, legally binding document tailored to your needs.

Popular searches:

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals pdf

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals sample

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals download

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals format

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals template

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals word

- Powerful, Secure Cryptocurrency Sales Agreement Template for Confident Crypto Deals free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews