Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals

12 Downloads

IT and Media

March 4, 2025

Sayantani Dutta

Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals

Blockchain has transformed how value moves across borders. As a result, the use and transaction of digital assets such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and other cryptocurrencies has surged. People and businesses are constantly buying, selling, and converting coins into fiat currencies like USD, opening up opportunities for trading, investment, and treasury management.

But once real money and high-value crypto enter the picture, you need more than an exchange interface or a wallet address. Under applicable law, you must protect your rights when selling cryptocurrency—especially if you are a business, a professional investor, or dealing with large sums. That is exactly where a robust, legally sound Cryptocurrency Sales Contract becomes indispensable.

Digital currency does share certain protections with traditional assets, but it is fundamentally different from the balance in your bank account. If you send ETH to the wrong wallet, there is no bank manager you can call to reverse the transfer. The blockchain is unforgiving, and mistakes are often irreversible.

On top of that, selling cryptocurrencies requires nuanced safeguards—escrow mechanisms, dispute resolution clauses, arbitration provisions, AML/KYC protections, clear agreement on market pricing, tax implications, and disclaimers dealing with extreme price volatility. All of this needs to be captured in writing and aligned with the governing law of the chosen jurisdiction.

A carefully drafted Cryptocurrency Sales Contract brings all of these requirements together into one enforceable document. It gives both buyer and seller clarity, protection, and a clear roadmap for what happens before, during, and after the transaction.

In this article, we explore what a Crypto Sales Contract is, why it is necessary, which key elements it must include, and the risks of using generic or incomplete free templates. We also introduce the Cryptocurrency Sales Contract Template by FreshDox.com—a comprehensive, customizable solution designed specifically for digital asset transactions.

If you are buying or selling cryptocurrency—whether casually, professionally, or as part of a larger business strategy—read on to understand how a well-structured crypto sales contract can safeguard your transaction, reduce disputes, and make your deals more secure and transparent.

What Is a Crypto Sales Contract?

The rise of cryptocurrencies has reshaped global finance. U.S. Dollars are no longer the only powerful store of value in town. Digital tokens such as BTC, ETH, USDT, and other altcoins now sit on the balance sheets of individuals, funds, and limited liability companies around the world, alongside traditional assets.

With this growth comes increased risk. High volatility and 24/7 markets create opportunities—but they also magnify the cost of mistakes and miscommunication. That is why a well-drafted Cryptocurrency Sales Contract is essential whenever you are selling Bitcoin, Ethereum, stablecoins, or any other digital asset.

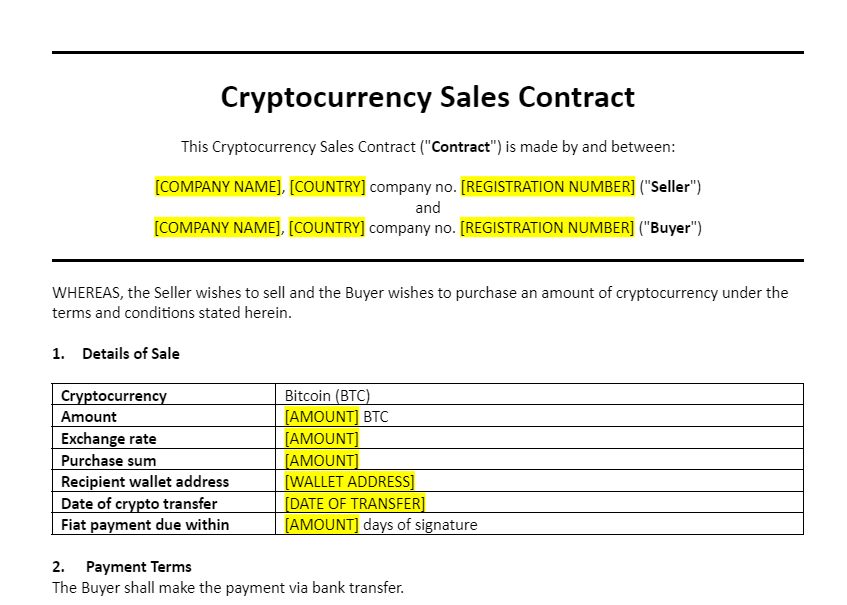

A Crypto Sales Contract is a formal, legally binding agreement that sets out the conditions under which cryptocurrency is sold. It captures critical details like:

- The type and quantity of cryptocurrency (e.g., BTC, ETH, USDT)

- The agreed price or pricing mechanism

- The payment method and currency

- Timing of both fiat and on-chain transfers

- Compliance statements (AML, KYC, tax, sanctions)

- Dispute resolution procedures and governing law

In a volatile market, this structure is vital. A robust cryptocurrency sales contract template provides a clear framework for dealing with price swings, payment delays, network congestion, and regulatory scrutiny, while keeping both sides aligned on the final outcome.

In short, the contract turns a risky, informal crypto transfer into a controlled, well-documented transaction that can stand up to legal and regulatory review.

Why Is a Cryptocurrency Sales Contract Necessary?

Having a Cryptocurrency Sales Contract is not just a “nice to have”—it is critical risk protection for anyone buying or selling crypto. Crypto might be digital and decentralized, but the legal risks, financial stakes, and regulatory expectations are very real.

1. Legal Clarity and Alignment

Without a written crypto sales agreement, it is surprisingly easy for buyer and seller to misunderstand basic terms—how much is being sold, at what price, in which currency, and by when. With market prices moving every second, even a small delay or ambiguous timestamp can create conflict.

A well-drafted contract removes this uncertainty by spelling out the exact amount of cryptocurrency, the agreed price or pricing formula, the payment method, and the timeline for both sides. Everyone knows what is expected, which dramatically reduces the risk of confusion or disagreement.

2. Protection for Both Buyer and Seller

Crypto transactions often involve sizeable amounts. Without a formal crypto purchase agreement, there is no reliable guarantee that both parties will honor their obligations. The contract acts as a safeguard: it binds the seller to deliver the agreed tokens and the buyer to pay the agreed consideration, with clear consequences if either side fails to perform.

3. Regulatory and Compliance Assurance

Regulators worldwide are tightening rules around digital assets. Crypto deals are now expected to respect AML and KYC measures, sanctions screening, and tax reporting rules. A Cryptocurrency Sales Contract can incorporate specific clauses that confirm both parties will follow relevant regulations and provide necessary information, especially for large or cross-border transactions.

Without this structure, parties can unknowingly miss important obligations—risking fines, frozen funds, or investigations.

4. Legal Recourse if Something Goes Wrong

If payment is delayed, crypto is not delivered, or a key condition is not met, a properly drafted crypto sales contract template sets out what happens next: negotiation, mediation, arbitration, or litigation. It defines jurisdiction and governing law, giving both sides a clear and efficient route to resolution.

Without such a contract, your options are limited, expensive, and uncertain, especially in cross-border disputes.

In summary, a Cryptocurrency Sales Contract offers clarity, protection, compliance, and a defined legal pathway—everything you need to make sure your deals are secure and enforceable rather than fragile and informal.

The Ideal Crypto Sales Contract: Key Elements

A Crypto Sales Contract is only as strong as the details it contains. To make a digital asset transaction truly clear, secure, and legally enforceable, several critical elements must be included. These components protect both buyer and seller and provide a practical framework for handling complex situations.

Here are the key elements every high-quality cryptocurrency sales contract template should cover:

-

Identification of Parties

: The contract should clearly identify both the buyer and the seller with full legal names, physical addresses, and reliable contact details. For businesses, include the legal entity name, registration details, and authorized signatories. This ensures accountability and eliminates confusion about who is bound by the agreement and who is responsible for performance. -

Description of the Cryptocurrency Asset

: The contract must specify exactly which cryptocurrency is being sold (Bitcoin, Ethereum, USDT, altcoin, etc.), the precise quantity, and whether fractional units are involved. Where relevant, the current market value or pricing benchmark can also be captured. This prevents disputes over what asset—and how much of it—is actually changing hands. -

Transaction Terms

: This section sets out how the economics of the deal work. It should clearly state the purchase price or pricing formula (fixed price, spot rate at a given time, or an index/oracle), currency of settlement (e.g., USD or EUR), and any conditions that might affect pricing. It should also detail the transaction timeline, including deadlines for payment and transfer on both sides. -

Payment Method

: Specify whether the buyer will pay in fiat currency, another cryptocurrency, or via an escrow service. For fiat, include method (wire transfer, bank transfer, or other), banking details, and any reference requirements. For crypto, specify the coin or token, the exact wallet address, and the network (e.g., BTC, ERC-20, TRC-20). This clarity helps prevent misdirected payments or transfers. -

Transfer of Ownership

: The contract must define when and how ownership of the cryptocurrency transfers from seller to buyer. Common triggers include the moment the transaction is confirmed on-chain or once the seller receives cleared payment. This section should make clear that once the cryptocurrency hits the buyer’s specified wallet, beneficial ownership has transferred. -

Representations and Warranties

: Both parties should confirm that they are legally capable of entering into the agreement. The seller typically warrants that they own the cryptocurrency free of liens and have the legal right to sell it. The buyer confirms that the funds used are lawful and that they understand the risks associated with crypto. These statements create a baseline of trust and legal protection. -

Compliance and Regulatory Considerations

: This section confirms that both sides will comply with relevant AML, KYC, sanctions, and tax requirements. It can require each party to provide identity documents, source-of-funds information, and any declarations needed under local law. This is particularly important in cross-border deals or high-value OTC trades, where regulators pay close attention. -

Dispute Resolution

: The contract should outline how disputes will be resolved if things go wrong. Will conflicts be handled through negotiation, mediation, arbitration, or court proceedings? Where will disputes be heard, and under what rules? A clear dispute resolution clause helps avoid chaotic, expensive litigation and provides a structured path to settlement. -

Governing Law

: Finally, the agreement must state which jurisdiction’s laws govern the contract. Since crypto transactions often involve parties in different countries, this clause is crucial. It clarifies the legal framework under which rights and obligations will be interpreted and enforced.

When these elements are clearly addressed in your Crypto Sales Contract, your transactions become more predictable, enforceable, and resistant to costly misunderstandings.

Risks of Inadequate Crypto Sales Contracts

The crypto ecosystem—spanning decentralized finance (DeFi), NFTs, smart contracts, and blockchain applications—is fast, global, and unforg

Popular searches:

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals pdf

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals sample

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals download

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals format

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals template

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals word

- Secure, Powerful Cryptocurrency Sales Contract Template for Safe Crypto Deals free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews