Debt Purchase Agreement

12 Downloads

Money and Finances

February 3, 2024

Erling Løken Andersen

What is a Debt Purchase Agreement?

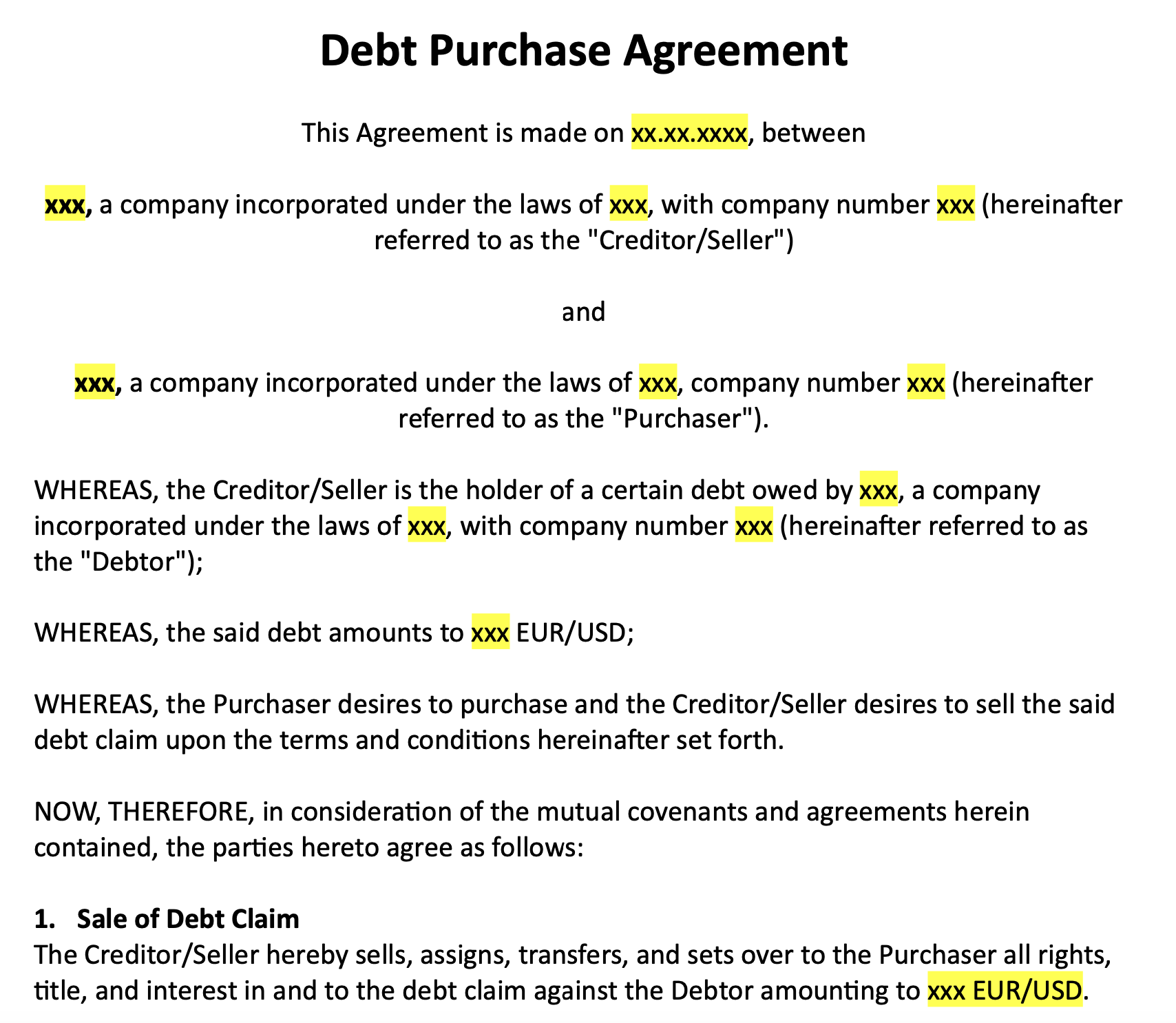

A Debt Purchase Agreement is a crucial financial document that outlines the terms under which one party (the buyer) agrees to purchase debt owed by a debtor from another party (the seller). This agreement plays a pivotal role in the financial and debt collection industries, providing a structured and legally binding framework for the transfer of debt from one entity to another.

Who Can Use a Debt Purchase Agreement?

Debt purchase agreements are versatile tools used by a wide range of entities, including:

- Debt Collection Agencies: Specializing in the recovery of debts, these agencies often purchase delinquent debts at a fraction of their original value to profit from their collection efforts.

- Financial Institutions: Banks and other lenders may sell off non-performing loans to focus on their core lending business.

- Investment Firms: Investors looking for opportunities in the debt market may purchase debts as part of their investment strategies.

- Businesses: Companies may sell outstanding invoices to improve their cash flow, transferring the responsibility of debt collection to another party.

Uses and Purposes of a Debt Purchase Agreement

The primary purpose of a debt purchase agreement is to legally transfer the ownership of debt. This process can serve various strategic purposes, such as:

- Risk Management: Sellers can offload risky debts to specialized entities better equipped to handle collection, reducing their exposure to non-performing assets.

- Liquidity Enhancement: Selling debt allows organizations to convert outstanding receivables into immediate cash, enhancing their liquidity position.

- Debt Recovery: Buyers with expertise in debt collection can efficiently manage and recover debts, making a profit in the process.

Examples of Relevant Use Cases

- Credit Card Debts: Financial institutions often sell off delinquent credit card debts to collection agencies.

- Medical Bills: Healthcare providers may sell unpaid medical bills to agencies that specialize in medical debt collection.

- Distressed Asset Investment: Investment firms may purchase large portfolios of non-performing loans from banks at a discount, betting on the recovery of a portion of those debts.

- Business-to-Business (B2B) Invoices: Companies facing slow-paying clients might sell these invoices to improve their cash flow.

Finding the Right Template for a Debt Purchase Agreement

Creating an effective debt purchase agreement requires careful consideration of legal, financial, and operational details. To ensure accuracy and completeness, utilizing a professionally designed template can be incredibly beneficial.

For those in need of a comprehensive and customizable debt purchase agreement template, Freshdox.com offers an excellent solution. By signing up and clicking the download button, you can can gain immediate access to a meticulously crafted template designed to meet the needs of both debt sellers and purchasers. This template not only simplifies the process of drafting a debt purchase agreement but also ensures that all critical elements are covered, making it an invaluable resource for anyone involved in the debt purchase process.

Conclusion

A debt purchase agreement is an essential tool for entities involved in the buying and selling of debt. It provides a legal framework that facilitates the transfer of debt, allowing for efficient risk management, enhanced liquidity, and effective debt recovery. Whether you are a financial institution, debt collection agency, investment firm, or a business dealing with outstanding receivables, understanding how to navigate and utilize a debt purchase agreement is crucial.

For those looking to draft a debt purchase agreement, Freshdox.com offers a robust template that can help streamline the process. By signing up and downloading this template, you can ensure that your debt purchase agreements are comprehensive, legally sound, and tailored to your specific needs.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews