Personal Guarantee Template

6 Downloads

Money and Finances

March 15, 2024

Sayantani Dutta

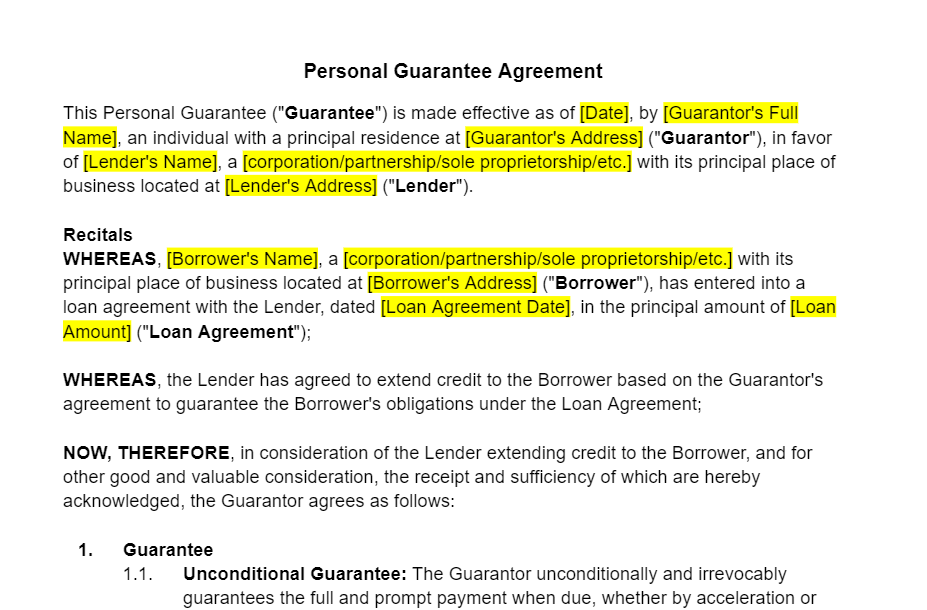

Securing a loan or credit for a business often requires more than just a promising proposal or a solid business plan. Lenders frequently seek an additional layer of security, leading many to request a Personal Guarantee. The Personal Guarantee Template offers a formalized way to provide this assurance, outlining an individual’s commitment to repay a loan if the primary borrower fails to do so. This article explores the necessity of a Personal Guarantee, the risks of not having a properly drafted template, and introduces FreshDox.com’s reliable Personal Guarantee Template as an indispensable tool for both lenders and borrowers.

What is a Personal Guarantee Template?

A Personal Guarantee Template is a legal document where an individual (the guarantor) agrees to accept responsibility for the financial obligations of a borrower (typically a business) in the event that the borrower defaults. This template outlines the terms under which the guarantor is liable, the extent of the liability, and any conditions or limitations of the guarantee. While it solidifies the guarantor’s commitment, it also clearly defines the scope of this obligation, providing security for lenders while giving guarantors a precise understanding of their potential liabilities.

The Importance of a Personal Guarantee

A Personal Guarantee is critical in the business financing process. It reassures lenders by providing an additional layer of security, often making the difference between obtaining financing or not. For new businesses or those without a substantial credit history, a personal guarantee can be instrumental in facilitating loan approvals. Furthermore, it demonstrates the guarantor’s confidence in the business’s viability and commitment to its success, potentially leading to more favorable loan terms.

Consequences of Not Having a Good Personal Guarantee Template

Without a well-drafted Personal Guarantee, guarantors expose themselves to undefined risks and liabilities. An ambiguous or generic template might not clearly limit the guarantor’s obligations, potentially leading to disputes over the extent of liability if the borrower defaults. Moreover, a poorly structured Personal Guarantee may not be enforceable in court, leaving lenders unprotected. This lack of clarity and protection can strain relationships between lenders and borrowers and may deter future financial support.

Key Elements of a Personal Guarantee Template

A comprehensive Personal Guarantee Template should include:

- Identification of Parties: Names and details of the borrower, lender, and guarantor.

- Guarantee Details: Scope of the guarantee, including which debts are covered.

- Conditions of Liability: Specific conditions under which the guarantor is liable.

- Limitation of Guarantee: Any limitations on the amount for which the guarantor is responsible.

- Term of Guarantee: Duration of the guarantor’s obligations.

- Revocation Terms: Conditions under which the guarantee can be revoked, if applicable.

- Signatures: Formal endorsement by the guarantor, and possibly witnesses, to affirm the agreement’s validity.

Including these elements ensures that the Personal Guarantee is clear, fair, and legally binding, protecting the interests of all parties involved.

Introducing FreshDox.com’s Personal Guarantee Template

To navigate the intricacies of securing business financing while safeguarding personal interests, FreshDox.com provides a meticulously designed Personal Guarantee Template. Our template is crafted to ensure clarity, fairness, and enforceability, delineating the guarantor’s liabilities while offering security to lenders.

Subscribing to FreshDox.com gives you access to our wide range of legal document templates, including the Personal Guarantee Template. With a 14-day trial period, users can explore the benefits of our Basic and Premium Plans. Basic Members are entitled to download up to three legal documents per month, while Premium Members enjoy unlimited access, ideal for business owners, financial institutions, and legal professionals.

By utilizing FreshDox.com’s Personal Guarantee Template, guarantors and borrowers can confidently enter into financial agreements, knowing that their obligations and protections are clearly defined. Avoid the uncertainties and risks associated with inadequate personal guarantees. Sign up for FreshDox.com today, and secure your business financing with our expertly crafted Personal Guarantee Template.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews