Promissory Note Template

4 Downloads

Money and Finances

March 7, 2024

Sayantani Dutta

In the intricate landscape of personal and business finance, a Promissory Note stands out as a vital legal instrument, formalizing the commitment of one party to repay a debt to another under specified conditions. This document not only facilitates clear communication between the lender and borrower but also provides a legally enforceable record of the loan. This article delves into the essence of a Promissory Note, its critical components, and the benefits of utilizing a professionally designed template from FreshDox.com to ensure accuracy, clarity, and legal validity.

What is a Promissory Note?

A Promissory Note is a written promise by one party (the maker or issuer) to pay a specified sum of money to another party (the payee or lender) at a predetermined future date or on demand. It includes details about the loan amount, interest rate, repayment schedule, and what happens in the event of default. The note serves as a straightforward, binding agreement, primarily used in personal loans, business loans, and real estate transactions.

The Importance of a Promissory Note

The significance of a Promissory Note extends beyond its function as a simple acknowledgment of debt. It outlines the exact terms of the loan, including the repayment plan and interest, thereby minimizing misunderstandings and disputes between the involved parties. For the lender, it provides a legal framework to enforce repayment, while for the borrower, it clearly states the obligations and the consequences of default, ensuring transparency.

Consequences of Not Having a Good Promissory Note

The absence of a well-drafted Promissory Note can lead to confusion and potential legal disputes over the terms of the loan. An unclear or incomplete note may not provide adequate protection for the lender or fair terms for the borrower, resulting in misunderstandings about repayment schedules, interest rates, and default conditions. This can complicate enforcement efforts and potentially damage the relationship between the parties.

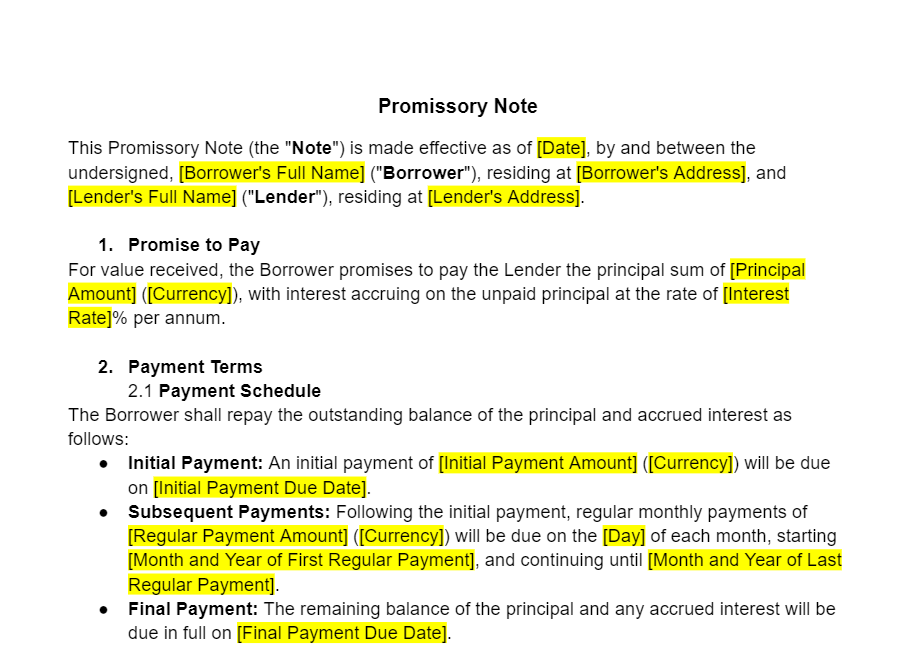

Key Elements of a Promissory Note Template

A robust Promissory Note Template should include several key elements to ensure its effectiveness:

- Principal Amount: The total amount of money being loaned.

- Interest Rate: The interest rate charged on the principal amount.

- Repayment Schedule: Clear terms outlining how and when the loan will be repaid, including any installments.

Introducing FreshDox.com’s Promissory Note Template

Recognizing the need for precision and legal compliance in financial agreements, FreshDox.com offers an expertly developed Promissory Note Template. Designed by legal professionals, our template ensures that all necessary elements are included to create a valid, enforceable promissory note tailored to personal and business needs.

By subscribing to FreshDox.com, members gain access to a wide array of legal document templates. Our 14-day trial period allows you to explore the benefits of both our Basic and Premium Plans. Basic Members can download up to three document templates per month, while Premium Members enjoy unlimited access, catering to the diverse needs of individuals, entrepreneurs, and businesses.

Secure your financial agreements with FreshDox.com’s Promissory Note Template. Sign up today to access our professional, customizable template, ensuring your transactions are documented accurately and legally.

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews