Sale Agreement for House Template

16 Downloads

Business Property & Lease Documents

March 8, 2025

FreshDox

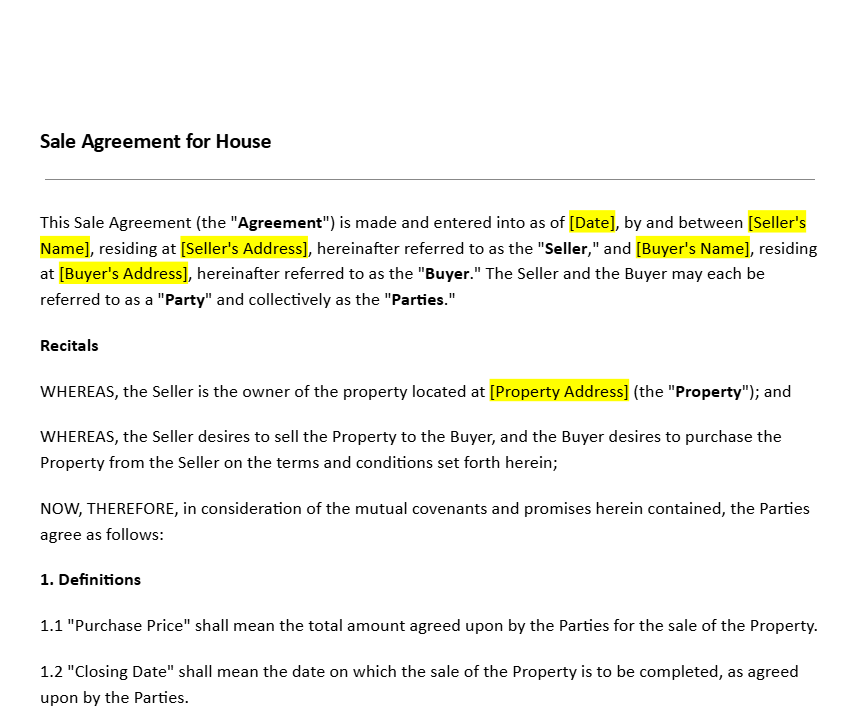

Sale Agreement for House is a legally binding contract that sets out every essential term of a residential property sale between a buyer and a seller. This real estate purchase agreement records the price, payment structure, timelines, legal conditions and contingencies under which ownership of the home will transfer. Because every property transaction involves high financial stakes, a clear and well-drafted Sale Agreement for House prevents misunderstandings and protects both parties right up to closing.

Once signed, the Sale Agreement for House governs the journey from the effective date until the final transfer of title. During this period, the buyer performs inspections and due diligence, the seller fulfils contractual obligations, and third parties—such as lenders, title companies, real estate agents and escrow providers—complete their checks and documentation in line with the agreement.

Setting Property and Legal Boundaries

For a Sale Agreement for House to be enforceable, the property must be clearly and legally identified. One widely used method is a “metes and bounds” description, which relies on a professional survey to define boundaries using physical features, directions and distances. It is especially useful for irregular parcels or rural land where subdivision maps are limited. Examples of metes and bounds references include:

- Natural features such as rivers, lakes, trees or rock formations.

- Man-made features like roads, fences, walls and boundary markers.

- GPS coordinates and compass bearings for each boundary line.

- Precise distances between points, usually measured in feet or metres.

These descriptions are incorporated into the Sale Agreement for House so that there is no confusion with neighbouring properties. Because natural landmarks can change over time, modern descriptions often combine visible reference points, survey monuments and GPS coordinates. If discrepancies appear during the title search or survey, they usually must be resolved or clarified before closing to protect both buyer and seller.

Types of Appurtenances in a House Sale

When you prepare a Sale Agreement for House, it is not enough to describe only the land. You must also clarify which “appurtenances” are included—physical improvements, legal rights and land-use benefits that attach to the property and normally transfer with ownership unless specifically excluded in the contract.

Physical Appurtenances (Attached Structures and Fixtures)

Physical appurtenances are permanent fixtures or improvements that form part of the real estate and are typically included in the sale unless expressly reserved. These may include:

- Driveways, walkways, sidewalks and perimeter fences.

- Detached garages, sheds, barns and outbuildings.

- Swimming pools, decks, patios and pergolas.

- Wells, boreholes, septic systems and underground tanks.

A precise Sale Agreement for House will specify which fixtures remain, which are excluded and whether any movable items (such as appliances) are included, helping to avoid disputes after closing.

Legal Appurtenances (Ownership Rights and Easements)

Some appurtenances are not physical objects, but legal rights that “run with the land.” A comprehensive Sale Agreement for House recognises these intangible benefits, which often add significant value. Examples include:

- Easements – Rights of way for shared driveways, utility lines, access roads or pathways.

- Water Rights – Rights to draw water from rivers, lakes, canals or wells linked to the property, where recognised by local law.

- Air Rights – Rights to build upwards or use the space above the land within applicable zoning limits.

These legal appurtenances normally transfer automatically with the property unless severed by statute or agreement, so they should be clearly referenced in the Sale Agreement for House.

Land-Use Appurtenances (Shared Amenities and Community Benefits)

In community developments and housing estates, buyers often gain access to shared amenities and common facilities. Typical examples include:

- Private roads or gated community access.

- Use of common parking facilities and visitor parking areas.

- Membership in a homeowner’s association (HOA) with access to a clubhouse, gym, playground or pool.

Because such benefits can affect both lifestyle and property value, a well-prepared Sale Agreement for House lists them explicitly and sets expectations about HOA rules and fees.

Financial Terms and Payment Structure

One of the most critical sections in any Sale Agreement for House is the financial terms. A robust real estate purchase agreement clearly defines the total purchase price, deposit amounts, payment schedule, closing costs and which party is responsible for each fee.

The down payment demonstrates the buyer’s financial commitment and often influences loan approval. Many house sale agreements also provide for an earnest money deposit, held in escrow as a sign of good faith and later credited towards the purchase price at closing.

If the buyer cancels the Sale Agreement for House without a valid contingency, the seller may be entitled to retain the earnest money as reasonable compensation. Conversely, if the seller unjustifiably withdraws, the buyer usually has a right to a refund and may have further remedies depending on local law.

The agreement should also allocate closing costs. Typical buyer-side expenses include:

- Title search and recording fees to establish and register ownership.

- Home appraisal and inspection fees.

- Attorney, notary or closing agent fees, where applicable.

Where the buyer uses a mortgage loan, the Sale Agreement for House should outline key financing terms, such as:

- Name of the lender or financial institution.

- Loan amount, interest rate and tenure.

- Key approval deadlines and any conditions for disbursement.

A financing contingency can allow the buyer to cancel or renegotiate if the loan is not approved by a stated date. If the seller provides financing directly, the Sale Agreement for House must also specify repayment schedule, interest rate, late-payment penalties and any balloon or early settlement terms, so the parties are clear about their rights and obligations.

Legal and Title Considerations

A thorough title search is an essential part of executing a Sale Agreement for House. It verifies that the seller has legal ownership and that the property is free from undisclosed liens, unpaid taxes, claims or lawsuits that could affect title. Any issues revealed during the search generally must be resolved before closing to safeguard the buyer’s position.

In many jurisdictions, the seller conveys ownership through a warranty deed or similar instrument, guaranteeing clear title and the right to sell. Buyers often purchase title insurance to protect against hidden defects—such as recording errors, unknown heirs, forged documents or unrecorded easements—that might arise after the transaction is complete.

Zoning laws determine whether the property can be used for residential, commercial or mixed purposes. Deed restrictions and HOA covenants may limit external changes, maintenance standards or the ability to rent out the property. A detailed Sale Agreement for House encourages buyers to review these legal limitations before signing so they do not inadvertently compromise future plans.

Escrow and Title Transfer

To ensure neutrality and security, funds and key legal documents are typically held in escrow until all conditions of the Sale Agreement for House have been satisfied. An escrow agent or closing attorney manages this process and prevents either party from accessing money or property prematurely.

The title company or legal representative checks the chain of ownership and confirms that all required releases, clearances and payoffs are in place. Written confirmation is often required that the seller’s obligations—including repairs, lien releases and tax payments—are fulfilled before funds are disbursed.

At closing, the buyer pays the remaining balance, the deed is executed and delivered, and the transfer of title is formally recorded with the relevant authority. From that moment, the buyer becomes the legal owner and the Sale Agreement for House has achieved its purpose.

Contingencies and Special Conditions

Most professionally drafted Sale Agreements for House include contingencies—conditional clauses that allow one or both parties to cancel or renegotiate under specific circumstances. These provisions protect buyers from being forced to close in unfavourable or risky situations.

The most common is the home inspection contingency, which allows the buyer to engage a qualified inspector to examine the property before closing. The inspection typically covers:

- Structural components such as foundation, walls and roofing.

- Roof condition, drainage and signs of leaks or water damage.

- Electrical, plumbing and HVAC systems for safety and functionality.

- Pest, termite, dampness or mould issues.

If serious defects are uncovered, the buyer may request repairs, negotiate a price reduction or credit, or cancel the Sale Agreement for House within the contingency period. Other common contingencies include sale of the buyer’s existing home, appraisal conditions and specific repair or upgrade requirements.

Additional addendums can be attached to the house sale agreement template to cover unique needs—such as occupancy after closing, inclusion of furniture or appliances, or warranties on recent renovations.

Tax Obligations and Prorations

Real estate transactions often involve tax considerations that must be properly addressed in the Sale Agreement for House. The contract should clarify how property taxes, municipal charges and special assessments will be shared between buyer and seller.

Because property taxes are typically billed annually or semi-annually, prorations ensure that each party pays only for the period they own or occupy the property. If the seller has prepaid taxes beyond the closing date, the buyer normally reimburses the seller for the unused portion on the settlement statement.

If taxes are overdue, the agreement should state that these amounts will be paid—often from the seller’s proceeds—before or at closing. Additional local charges may include:

- Special municipal assessments for infrastructure, roads or utilities.

- School district taxes that can affect both property value and future liabilities.

In many regions, a change in ownership triggers reassessment of property value, which may lead to higher tax bills going forward. A clear Sale Agreement for House encourages both parties to understand these implications in advance.

Legal Considerations and Customization

Because property laws and practices vary by jurisdiction, each party should consider obtaining legal advice before signing a Sale Agreement for House. The contract must comply with local statutes, disclosure regulations and consumer-protection requirements.

Many agreements include dispute-resolution provisions—such as mediation or arbitration—to avoid lengthy court proceedings. They also define what constitutes a “business day” for time-sensitive steps like inspections, financing approvals and contingency deadlines, so there is no confusion about timing.

If unforeseen events delay the transaction—financing issues, title problems, repair delays—the parties may agree to extend deadlines or apply specific penalties. Additional disclosures, such as lead-based paint notices for older homes or reports on prior structural work, may also be incorporated.

By customizing a standard Sale Agreement for House template, buyers and sellers create a document that reflects their specific transaction while maintaining clarity, precision and legal protection.

The Importance of Using a Sale Agreement Template

A professionally drafted Sale Agreement for House template offers a ready-made legal framework aligned with industry standards and local regulations. Instead of drafting from scratch, buyers, sellers and agents can rely on pre-formatted documents that already contain key clauses—property description, disclosures, financing terms, contingencies, timelines and closing procedures.

Templates save time and reduce the risk of omitting crucial provisions. At the same time, they can be tailored by real estate professionals or attorneys to address unique elements in a transaction. This balance between standardisation and customisation gives both efficiency and legal security.

Download a Free Sale Agreement for House with a Free Trial of FreshDox

If you want a professionally structured Sale Agreement for House without starting from a blank page, FreshDox gives you instant access to a ready-to-use template that you can adapt in minutes. Simply sign up for a free trial and download a carefully drafted real estate purchase agreement in Word or PDF format.

Our Sale Agreement for House templates are designed to cover all essential elements of a residential transaction—property details, appurtenances, financial terms, contingencies, title requirements and closing procedures—so you can focus on negotiations rather than formatting. You can customise the language, add jurisdiction-specific clauses and share the document easily with your buyer, seller, attorney or agent.

Start your free trial with FreshDox today, download a Sale Agreement for House template built for clarity and protection, and give your next property transaction the structure, transparency and legal confidence it truly deserves.

Popular searches:

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Start your 7-day free trial and access professionally drafted legal documents built for business use.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews