Uniform Residential Appraisal Report (URAR) Template – Word & PDF

10 Downloads

Real Estate

March 11, 2025

Sayantani Dutta

Uniform Residential Appraisal Report (URAR) Template is the standard document lenders and appraisers use when they need a clear, well-supported opinion of a home’s market value. This URAR template helps structure the residential appraisal process for single-family homes, condominium units, and properties in planned unit developments (PUDs), so every key detail is documented in a consistent way.

Lenders rely on the Uniform Residential Appraisal Report (URAR) template when reviewing mortgage applications, and homeowners often encounter it when buying, selling, or refinancing. The report summarises the property’s physical condition, location, and comparable sales, and gives all parties—lenders, buyers, and borrowers—a clear view of current market value. In short, the URAR template keeps residential real estate transactions transparent and grounded in data.

What Is a Uniform Residential Appraisal Report (URAR) Template?

A Uniform Residential Appraisal Report (URAR) template is a standardised real estate appraisal form layout used to document the appraised value of a residential property for lending and underwriting purposes. It mirrors the structure of the widely used URAR appraisal form associated with Fannie Mae and Freddie Mac, and is designed to capture all of the information lenders expect to see in a residential appraisal report.

Using a consistent URAR template helps appraisers disclose their professional opinion of value, based on property characteristics, market conditions, and comparable sales. Lenders review the completed Uniform Residential Appraisal Report to understand the collateral behind a loan, while buyers and sellers use it as an objective reference point for negotiations. The purpose is simple: provide a well-supported, unbiased estimate of what the property is worth as of a particular date.

Each Uniform Residential Appraisal Report is tied to a specific property address and is usually assigned a unique file or reference number. The URAR template is most commonly used for one-unit properties—single-family homes, condos, and PUD units—but it can also be adapted for some small multi-family residential assignments. By using a uniform structure, the Uniform Residential Appraisal Report (URAR) template brings consistency to residential appraisals across different markets.

Key Components of a Uniform Residential Appraisal Report (URAR) Template

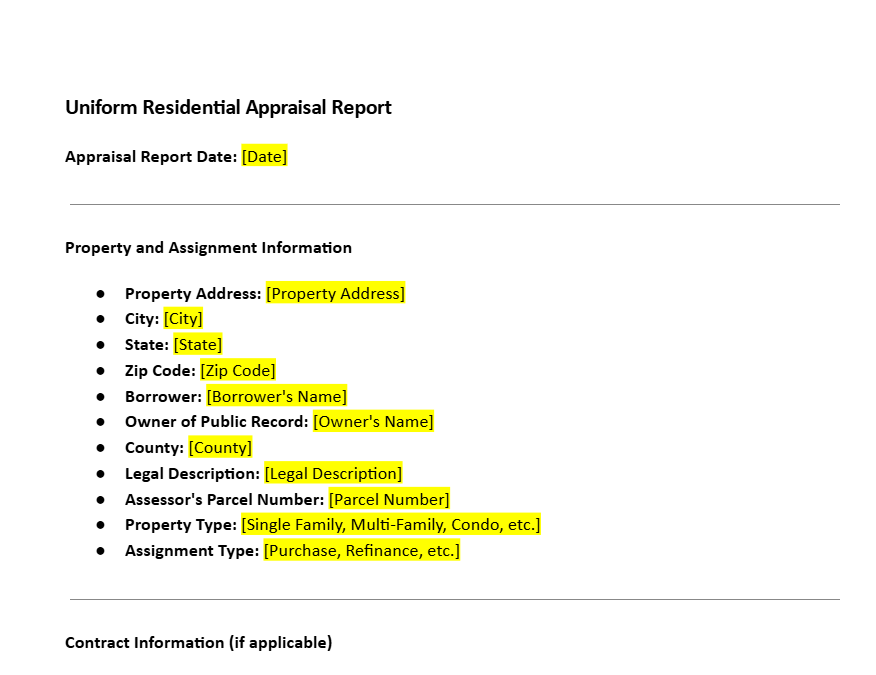

A well-prepared Uniform Residential Appraisal Report (URAR) template starts with core identifying information: the subject property address, legal description, parcel or lot number, borrower’s name, client/lender name, and the date of the inspection. It also records details like the property type, occupancy status, and intended use of the appraisal.

The URAR template then moves into the property’s physical characteristics. The appraiser documents the gross living area (square footage), number of bedrooms and bathrooms, year built, construction quality, and overall condition. Site details such as lot size, topography, utilities, and zoning classification are also captured to show how the land itself supports the property’s value and potential use.

Additional improvements—such as garages, carports, decks, porches, or outbuildings—are described and, when relevant, shown in a simple building sketch. The sketch provides a visual overview of the layout so reviewers can see how the space is configured, not just how large it is.

The URAR template also includes sections for special features and amenities: upgraded kitchens or bathrooms, fireplaces, landscaping, energy-efficient systems, or other items that may influence marketability. Throughout the inspection, the appraiser takes notes and photographs, which help support the final value conclusion.

Any explanations that do not fit the main check-box fields—such as unusual conditions, repairs needed, or clarifications about the neighborhood—are added in commentary or addendum sections of the Uniform Residential Appraisal Report. Finally, the appraiser signs the report, certifying that they have followed professional standards and acted impartially. This combination of structured data, narrative comments, and visuals makes the URAR template a detailed guide to the subject property.

Valuation Methods Used in a Uniform Residential Appraisal Report (URAR)

The Uniform Residential Appraisal Report (URAR) template is built around recognised valuation approaches. Appraisers do not simply pick a number; they reconcile information from several methods to produce a well-supported opinion of market value.

Sales Comparison Approach: For most single-family homes, the sales comparison approach carries the most weight. The appraiser identifies comparable properties (“comps”) that have sold recently in the same or similar market area. These comps should share key characteristics with the subject—location, lot size, design, age, and condition.

The appraiser then adjusts each comparable sale for differences, such as extra square footage, a finished basement, a garage, or updated finishes. After adjustments, the appraiser analyses the range of indicated values to arrive at a supported estimate. This approach connects the Uniform Residential Appraisal Report directly to what buyers have actually paid for similar homes.

Cost Approach: The cost approach looks at what it would cost to rebuild the property today, including land value and construction costs, and then deducts depreciation for age, wear and tear, and functional or external obsolescence. This method is often helpful for newer or unique homes where reliable comps are limited. On the URAR template, it provides an additional check on the sales comparison results.

Income Approach: For properties that generate rental income—such as small multi-family homes or investment properties—the income approach may also be relevant. The appraiser estimates market rent and applies an appropriate rate to convert income into value. While this approach is less prominent for owner-occupied single-family homes, the Uniform Residential Appraisal Report allows the appraiser to include it when appropriate.

After developing these approaches, the appraiser reviews and reconciles them, usually placing primary emphasis on the sales comparison approach for typical one-unit residential properties. The final figure reported on the URAR template is the appraiser’s concluded market value as of the effective date of the appraisal.

Market Conditions in a Uniform Residential Appraisal Report (URAR)

A complete Uniform Residential Appraisal Report (URAR) template also captures the broader market conditions surrounding the property. Real estate values are influenced by supply, demand, and buyer sentiment, so the report requires the appraiser to comment on trends in the relevant neighborhood and market area.

The appraiser considers whether prices are generally rising, stable, or declining; how long comparable properties stay on the market before selling; and whether there is a shortage or oversupply of similar homes. These indicators help lenders and borrowers understand how competitive the market is and how quickly the subject property might sell.

Public records and listing data are used to verify prior sales, track median prices, and identify any patterns that could influence value. Zoning restrictions, planned developments, and environmental factors such as flood zones or easements may also be noted when they impact the property’s highest and best use.

By combining property-specific data with market-level analysis inside the Uniform Residential Appraisal Report, the URAR template gives a realistic picture of where the home stands in its local marketplace.

Why a Uniform Residential Appraisal Report (URAR) Template Matters

For lenders, a well-prepared Uniform Residential Appraisal Report (URAR) template is a key risk management tool. It helps ensure the loan amount is aligned with the collateral’s market value, reducing the risk of lending more than the property is worth. Underwriters use the URAR to confirm that the property meets guideline requirements and that the value conclusion is supported by credible data.

Borrowers also benefit from a clear, organised Uniform Residential Appraisal Report. When purchasing or refinancing, the appraisal report gives them an independent perspective on what the home is worth, helping them set expectations, plan their finances, and respond to any valuation-related conditions from the lender.

In other contexts—such as estate settlements, divorce proceedings, or buyouts between co-owners—a URAR appraisal can provide a professional, documented opinion of value at a specific point in time. Because the format is standardised and widely recognised, it offers a level of credibility that informal estimates cannot match.

The URAR’s alignment with major secondary market standards adds further weight. Real estate professionals, attorneys, and lenders know what to expect: consistent sections, clear certifications, and detailed data that can be reviewed and audited. This makes the Uniform Residential Appraisal Report (URAR) template an important bridge between buyers, sellers, appraisers, and lending institutions.

How the URAR Template Fits into the Appraisal Process

The process behind a Uniform Residential Appraisal Report (URAR) template is a blend of fieldwork and analysis. It typically begins with the appraiser’s inspection of the subject property. During this visit, the appraiser measures the home, reviews the layout, notes visible defects or needed repairs, and documents features such as flooring types, fixtures, and amenities.

Photographs are taken of the exterior and interior, along with street and neighborhood views. These images are later included in the Uniform Residential Appraisal Report to support the description and provide visual context for reviewers who cannot visit the property themselves.

After the inspection, the appraiser researches recent sales, active listings, and pending transactions in the relevant market area. Multiple Listing Service (MLS) data, public records, and other databases are used to identify comparable properties. The appraiser analyses how each comp relates to the subject, adjusts for differences, and evaluates which sales are most similar and most reliable.

Once the data has been analysed, the appraiser completes the URAR template, entering property information, market commentary, comparable sales grids, and reconciliation of the value approaches. The report is then signed, with the appraiser certifying that they have followed applicable professional standards and acted independently.

Because property values change over time, the Uniform Residential Appraisal Report represents a snapshot of value as of a specific effective date. For lenders, investors, and homeowners, that snapshot helps guide informed decisions in a constantly moving real estate market.

Benefits of Using a Uniform Residential Appraisal Report (URAR) Template

Using a structured Uniform Residential Appraisal Report (URAR) template allows appraisers to focus on analysis instead of formatting. A prepared template includes all the standard sections, certifications, and data fields expected in a residential appraisal, reducing the risk of omissions and inconsistencies.

For busy appraisers handling multiple assignments, a professionally designed URAR template is a practical way to maintain quality and efficiency. It helps ensure that every report addresses the key points lenders look for: clear property description, supported market value, and transparent commentary on conditions and assumptions.

Lenders benefit as well. Reviewing a familiar, standardised form makes it easier for underwriters to locate critical information and compare different reports. Borrowers see a clear, organised explanation of how the value was determined, which can build confidence in the process.

Download a Uniform Residential Appraisal Report (URAR) Template from FreshDox

If you work with residential appraisals, having access to a well-structured Uniform Residential Appraisal Report (URAR) template can significantly streamline your workflow. FreshDox provides a URAR-style template designed to mirror the structure of a standard residential appraisal report, which you can adapt to your own practice and compliance requirements.

You can customise the Uniform Residential Appraisal Report (URAR) template to match your preferred wording, add branded details, and integrate it into your existing appraisal process. Download the URAR template in Word or PDF format, align it with your reporting standards, and explore additional real estate and lending-related document templates available from FreshDox.

Popular searches:

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF pdf

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF sample

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF download

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF format

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF template

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF word

- Uniform Residential Appraisal Report (URAR) Template – Word & PDF free

Related Templates

Discover more templates that align with your needs and preferences.

Ready to Sign Up?

Sign up for FreshDox.com’s 7-day trial and discover why so many individuals and businesses trust us for their legal document template needs.

- Cancel any time

- 7-day free trial

- From 300+ Customer Reviews